22 Content Highlights To Remember From 2013

/ Tweet“And, the audience sprang to its feet and cheered…”

If you’re in the online content business, such physical signs of positive reinforcement are hard to come by. But, know that what you do is appreciated and often celebrated.

The following list contains 22 pieces of content. I cheered these gems when I learned about them at one point or another in 2013 and they've stood the test of as much as 12 months' time.

As in previous Rock The Boat Marketing annual content highlights (last year’s), this is an idiosyncratic compilation across multiple digital marketing subject domains. Most of these I like for their content, some for their design, their delivery or the evolution they represent. They're presented in no particular order.

Want to play along next year? Come join me on Twitter where the majority of these highlights were surfaced by the awesome information hounds I either follow or am led to. In 2013, I also explored more content on LinkedIn, Google+ and Pinterest—follow me on those networks or just check in once in a while on this site's Resources page.

1. How Google Reads Minds

The results that Google presents to you the searcher are based on how it “understands” the words you type into the search engine. You know what you want but your search query may have literal meanings that you don’t intend.

This excellent Vertical Measures graphic from April details what Google has in place to read your mind, and how that's evolving. The screenshot below is just a slice of the full infographic.

2. No Money Manager Is An Island

Part of being social is taking part in the broader community. Quite a few mutual fund and exchange-traded fund (ETF) firms seemed to acknowledge that this year with how they managed their social accounts. We saw more accounts following others, more sharing of others’ content and an occasional #FF (Follow Friday) recommendation.

No less than PIMCO’s Bill Gross acknowledged that investment and economic insight takes a village—and people showed a lot of interest in who influences this influential money manager. From August, this is one of PIMCO’s all-time most favorited tweets. It would have been too much to expect him to use the Twitter handles.

Gross: Strategists/writers I follow? Dalio, Durden, Bianco, Arnott, Aitken, Santelli, Grant, Grantham, Inker, Marks, Quaintenance & Brodsky

— PIMCO (@PIMCO) August 9, 2013

3. And We Are Doing This Why?

“…The silence around the economics of content is deafening,” says Forrester analyst Ryan Skinner in this July post 16 Ways to Turn Content Marketing into Business Value. Skinner then proceeds to break down what he names as catalysts of content marketing value: brand, next click, relationship, reach, data.

Many firms aspire to be content factories today, which is all well and good. Before you plow ahead into production, read the Skinner post to make sure you’re aligning what you’re doing with what drives value.

4. While You're At It, Throw In Some Sincerity, Too

It’s a good idea to present yourself as authentic and transparent. But, um, as this Tom Fishburne cartoon from June suggests, you may need to bring that in-house.

5. DIY Dashboard Help

Marketers need to be more analytical. That drumbeat got louder and louder as the year progressed. If you’ve ever found yourself looking for Excel training applied for marketers online, you may be happy to learn about this Excel dashboard series. Written by Annie Cushing and augmented by a video or two, it started in June on Search Engine Land and then continued on Marketing Land.

6. Showing Signs Of Life On Google+

This November update isn’t on the list because the content is break-out. It’s a little more Facebook-y than I like for Google+.

But it’s an example of how the largest mutual fund company is not just experimenting but succeeding (relatively speaking) in engaging people on a social network that most investment companies have decided to ignore.

More than 700,000 people have circled the Vanguard account, 22 people +1ed this post, three shared it and 13 commented. And, what other social network (i.e., somebody else’s platform) provides such open real estate (no ads) for your message and yours alone?

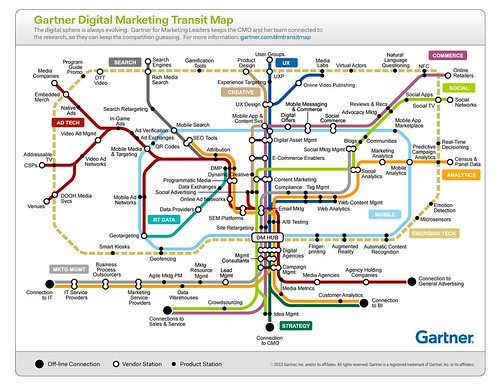

7. A Map Can Show You Where You Need To Go

Infographics were so 2010. Still, I couldn’t resist spending several minutes of my life with this Gartner Digital Marketing Transit Map released in June.

Gartner says, "Organizations should use the map to identify the connection among business functions, applications tracks and providers. Map elements can be used to find additional research or structure questions about strategy and best practices as well as providers, products and selection criteria. It is also a useful device for mediating discussions between marketing and IT."

Show this to the people in your life who think all digital marketers do is email and the Website.

8. Right Time, Right Place

Advertising a financial advisor-only conference call? On Twitter? By Royce Funds? Yes, yes and yes. In October, Royce Funds showed its leading edge lead-generation chops by employing a Twitter card to drive sign-ups.

9. Lovely To Learn From

Design is rarely front and center for digital marketers, and yet it's especially important at a time when so many clients and prospects access information via mobile devices. You’ll take a lot from this Prophets Agency presentation published last January—and follow the account to learn when the 2014 outlook is available.

Trends in interactive design 2013

from

10. Where Do I Sign Up?

Few of us have high expectations when we go to a conference Website. Oh sure, the highest-profile events command the resources to deliver a functional, pleasant experience, but the majority of event sites lack luster.

That’s not the case with this vibrant LPL Connect 2013 site. I’d bookmarked it during the August event (which I attended by hashtag only) and hoped it would still be reachable when I returned to it for this list.

Outstanding—not only did it not go dark after the event, it’s been updated. Why would you go to a conference site afterward? Just one reason, probably. LPL lets the presentation archive dominate the home page, while most event sites require attendees to go looking. All that’s missing from my cursory review of the site is a Search capability.

11. Sharing The Data

TD Ameritrade knew there was value in providing insights on what its investors were thinking. Previously, according to their Website, they'd satisfied media and others’ requests for information with opinion surveys.

That approach was upgraded considerably in January with the release of a quantitative, behavior-based index that reports on what retail investors are actually doing.

The Investor Movement Index, based on a sample of the firm’s 6 million accounts, is a tool that has ongoing marketing and communications utility. It raises the bar for other investment companies whose proprietary data contains insights when aggregated.

Wouldn’t it be cool (and ostensibly instructive) to someday get a full picture of what investors and 401(k) participants are doing, via a single site driven by the sampled and anonymized data from individual brokerage and investment firms?

12. Two Pictures = 1,000 Words

Nowadays, people are relying on mobile devices to share what they see around them and especially the news. We all need to plan accordingly.

Not that you needed the previous two sentences after looking at these photos comparing people anticipating a 2005 papal announcement in St. Peter's Square, Vatican City, and those in March 2013.

If your client or boss isn't taking mobile strategy seriously, show them this picture of the Vatican crowd: pic.twitter.com/CPlrCbwrnp

— Fike (@MichaelFeldman) March 15, 2013

13. We Were Right There With You

From Google Earth to Reddit to Twitter, the Internet was focused on April’s Boston Marathon-related bombings.

From my perspective, this is the best content that came out of it. The rest of us were worried about Bostonians. In an inevitably schmaltzy way (is there any other when Neil Diamond is involved?), this video demonstrated their resilience.

14. The Dope On SERPs

Google’s search engine results page (SERP) changed big-time in 2013. In October Moz provided a visual guide to all the variables that could possibly appear in (mostly organic) search results and why. Study the full guide (the screenshot below is just an excerpt) but don’t bother printing it—things may have changed since you started this post.

15. Starting With Why

Water Investing, Calvert’s iPhone/iPad app launched in November, is different from other investment manager apps in at least four ways:

- It’s about something—the world's water crisis—as opposed to being a container of investment commentary and investment product information. The embedded video is effective at using the medium to communicate more than just words and images could.

- Its Daily Drip is an aggregation of others’ (non-Calvert) views and updates.

- It offers the tweets of not just the firm but three analysts using a #CalvertH20 hashtag.

- It includes a "Play" feature that uses the device's camera to simulate a water effect. Kinda corny but something to build on.

16. A Framework For Your Work

You could land on any blog post on Avinash Kaushik’s Occam’s Razor site and find Web analytics gold. But, make a special effort to read See-Think-Do: A Content, Marketing, Measurement Business Framework. Your entire day every day can be filled in the pursuit of digital marketing tactics. This post is a nudge to be more strategic in how you think about your work and its effectiveness.

BREAKING: Sorry, I can’t let this post fly without also mentioning a December post in which Kaushik lays out a digital marketing “ladder of awesomeness.” Another must-read. You might just want to subscribe to this site.

17. Endorse Me As Father of The Bride

A chuckle is the last thing I expect when I log into LinkedIn but, no kidding, some of the photos being used for profiles are funny. This MarketingProfs 19 More Reasons Your LinkedIn Headshot May Be an Epic Fail presentation is not exaggerating. Too bad it doesn't touch on one of the types of photos I commonly see. Men in tuxedos, really?

19 Reasons Your LinkedIn Photo Is an Epic Fail

from

18. Looking Under The Hood

Last week was all about learning an hour of code. I’m guessing most of you sat that one out. But this week, how about learning to just read the source code on your Website?

If your work has anything to do with optimizing your site for search engines, this KISSmetrics post from August provides an excellent foundation for how to confirm what's happening on your site. Bonus: Check other sites' source code to learn what they're up to. This screenshot is just the first example the post provides.

19. Out Of The Ashes

First there was the dramatic reading by James Earl Jones and Malcolm McDowell of Jenna’s Facebook for a Sprint commercial. I loved that. Moving onto the digital realm, on YouTube two actors re-enacted a YouTube comment war between two One Direction fans.

But the investment industry has nothing to do with most memes. We wouldn’t do the Blurred Lines knock-off videos, twerking is out of the question, and the President of the United States took part in a selfie before an asset manager CEO has.

So, while I suffered along with other financial services marketers when the #AskJPM Twitterchat imploded, I have to say that a subsequent CNBC video published the next day thrilled me. Stacey Keach provides the dramatic reading.

It didn’t go anywhere (just one tweet!) but let history show that this may have been the first stab at a meme. Thanks to my buddy Todd Donat for first sending me the link to this.

Too soon? I hope not.

20. In Another's Eyes

When one Website sneezes, do the other Websites catch a cold? Nah, the failings of healthcare.gov just inspired Slate in October to show how iconic sites Facebook, Yahoo, Amazon and Windows would have made the site over in their own image and likeness. Pretty genius.

21. Borrowing From The Journalists

The introduction of data, including visualization, can add to the usefulness of content you’re creating.

But this is yet another competency that people in marketing positions today will have to learn on the job. Most likely, you will not be crunching the numbers, you’ll be managing the data-driven work. To be an effective partner and contributor you may have to dig in.

It was prepared for journalists and not marketers, but the Data Journalism handbook may be just the resource you need. The handbook, a version of which is also available in print, is a project of the European Journalism Centre’s Data Driven Journalism initiative.

22. Tech To Watch Out For

The Marketing Arm’s Tom Edwards, the author of this contribution to iMedia Connection, sounds like he has one cool job as an evaluator of interactive/new media and emerging tech.

We’re the beneficiaries as he outlines—and provides plenty of examples of—six marketing technology trends. Included: collaborative commerce, curation, second screen and social TV, rich social media, crowdsourcing and social and CRM. The screenshot below shows the user interface of a social TV app.

This post will do it for me for 2013. Happy Holidays to all and see you back here in the first week of 2014!