The Added Significance Of Multiple Email Opens

/ TweetHow are you measuring the effectiveness of your email marketing? You’re looking at open and click-through rates (CTRs), no doubt. But recent research suggests that multiple email opens may have added significance.

Failure to understand multiple email opens could result in an under-assessment of the appeal of your emails. This is particularly germane for those of you who pay advertising partners for email blasts.

We’ll get into it below but fair warning: This delves into a fuzzy area of email campaign performance measurement.

Finserv Content Isn’t So Easily Dealt With

For the last few years, data has shown that mobile devices are being increasingly used to read emails. And, email marketers have made design, layout, content and even functional (e.g., click to call) adjustments to drive opens and click-throughs on smartphones and tablets.

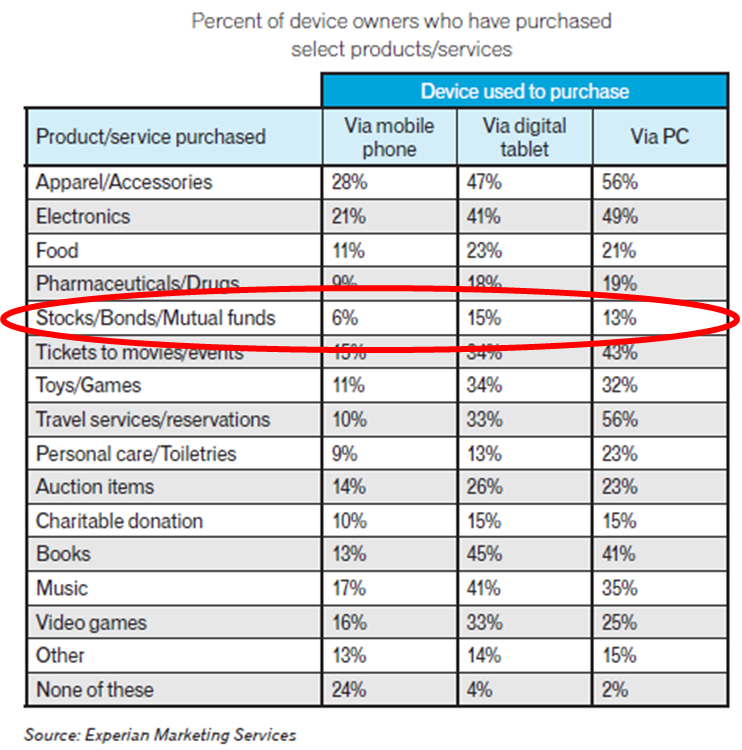

Mobile devices are an efficient way of using stolen moments on the go to stay on top of an Inbox. But not every email—and I’m thinking of investment management offers of whitepapers or videos here—can be dealt with so quickly or easily while on a phone.

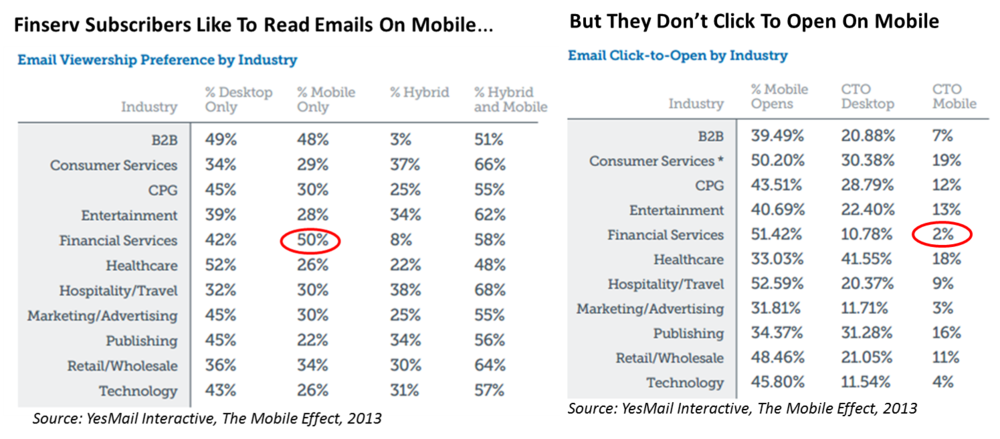

In fact, YesMail last year reported some interesting data on financial services emails in general (probably not asset manager emails sent to financial advisors) accessed on mobile devices. While financial services email subscribers topped the list of industry email subscribers who preferred to view emails on mobile, it was at the very bottom of the list of those who clicked to open on mobile.

A 'New Standard' Of Engagement

In this latest report, email provider Campaign Monitor is highlighting a new email consumption habit it refers to as “triaging”—aka flagging the good ones to be read later, possibly on a different device. A triaged email was opened, not clicked through then and there, but possibly saved to be read again later.

“The shift to mobile has made it more difficult to get readers to engage with your content...The new standard in successful email marketing is not only capturing a subscriber’s attention but holding it long enough to get them to return and engage with your content,” says Campaign Monitor in its Email Marketing Trends report.

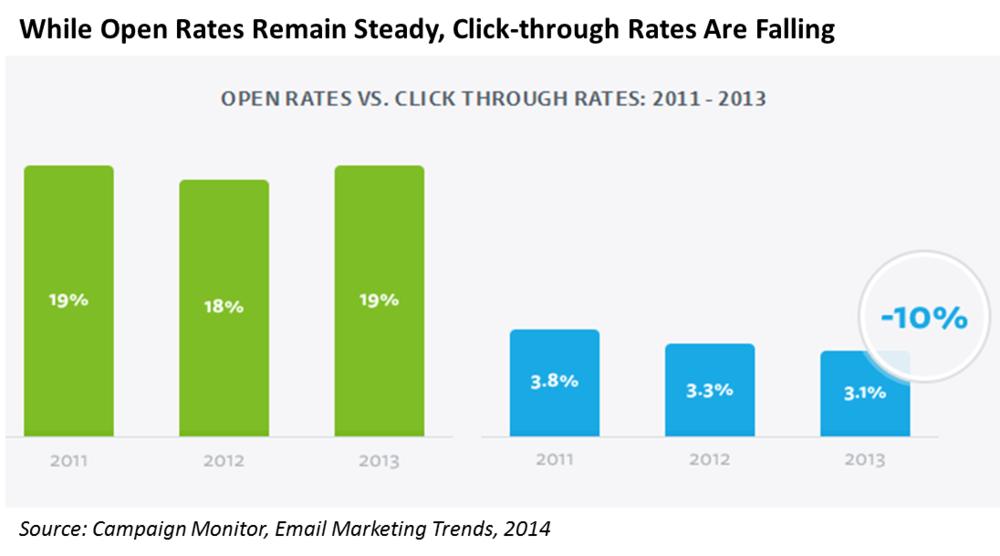

As email opens shift to mobile devices, there’s been a correlating decrease in click-throughs—a 10% decline from 2012 to 2013 alone, according to Campaign Monitor.

Unique Opens Vs. Total Opens

Of course, your reporting is duly tracking click-throughs. But if all you’re tracking is opens and CTRs, you may be missing something.

Here’s where it gets frustrating. Data that reports on email open activity is routinely accompanied with a few qualifiers that seek to explain why open data may be both under- and over-counting.

Email open tracking depends upon the downloading of an invisible 1×1 pixel gif image as embedded by the email provider.

As the Internet Advertising Bureau (IAB) warns, “some opens may not be detected when, for example, the user has images disabled, is on a mobile device, or has elected to receive text-only emails.” That would lead to under-counting.

And, as Campaign Monitor acknowledges in its study, “Apple devices display images by default—thereby automatically registering an open—whereas many Android email clients don’t.” This could result in overrepresentation of Apple users in your data.

On the other hand, the IAB explains, “the metric may also falsely indicate some impressions when the message is briefly loaded into the preview pane but may not be actually viewed by the recipient.” Some email clients render HTML within the preview pane—every time the user scrolls through the Inbox and passes your message, it will count as an open.

Ugh!

The industry’s answer to this has been to focus email senders on Unique opens, a metric that eliminates the duplicates included in Total opens.

But the Campaign Monitor research raises a possibility that makes sense, especially for investment firms that are heavy users of emails to communicate with mobile-reliant financial intermediaries. It stands to reason that the multiple opens number includes some opens that indicate your content’s ability to prompt a second look.

A second look isn’t a click-through but it’s something. It’s more than an open and out. And, at a time when click-through rates are falling at a rate of 10% per year, multiple opens seem to be worth spending some time to better track and understand over time.

I would try to get my hands on your firm's Total Opens and Unique Opens data, including from media partners whose lists you use. Data that enables you to segment email response by device and email client would also be valuable to add to your reporting.

Your Best Prospects Are On A Non-Mobile Device

Mobile complicates an already complicated reporting dimension. Ready for more? Here are some additional findings included in the Campaign Monitor report based on its analysis of data for more than 1.8 billion opens from almost 6 million 2013 campaigns:

- The first battle is to win the mobile open: As has been well documented, an increasing percentage—41% according to Campaign Monitor—of email is being read on mobile devices. The most common time to click on an email is when it’s initially opened. 87% of clicks will happen then.

And yet, the fewest clicks happen the first time an email is opened on a mobile device. Only 78% of clicks on mobile devices happen on the first open.

- Multiple opens more common than click-throughs: If users open an email on a mobile device, they are more likely to open it a second time than they are to click from their phone or tablet. Overall, 8% of people who opened an email on mobile clicked right away, while 23% opened it again later. (This would be a very broad benchmark to measure your own multiple opens/total open rate against.)

- A second device optimizes the second chance: If a mobile reader opens an email again from a different device, more clicks happen. Mobile readers who open emails a second time from their computer are 65% more likely to click through. The Campaign Monitor Web page has a flowchart that visualizes this.

Your thoughts?