What Do Advisors Use Fund Company Websites For?

/ TweetWhat are financial advisors using fund company Websites for? That's the question asked by an Advisor Perspectives survey, the results of which I've been anxious to see since January. The findings are elaborated on in a post published yesterday on the AP site. They reflect the responses of 282 investment advisers, registered representatives, financial planners and insurance agents who completed the survey online.

While I urge you to check out the full report, below are a few of my notes.

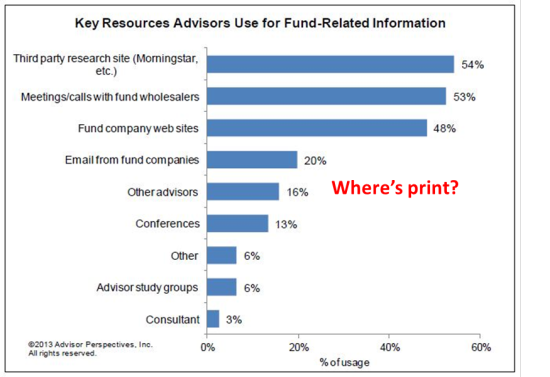

Websites are the #3 information resource after third-party sites and meetings/calls with wholesalers.

RTB’s take: Congratulations, digital marketers, you’ve reached the pinnacle of what you can hope to achieve. Can you envision Websites climbing any higher as an information source than third place, surpassing either third-party sites or meetings/calls with wholesalers and other real live people? I can't.

Note that print communications are nowhere to be found in the answers the Advisor Perspectives provided—I guess reliance on them is lumped into the Other category that 6% of advisors responded to.

Print’s fade is no less than stunning. Just six years ago a SwanDog/FRC study reported that firms with less than $50 billion in assets under management spent 40%-60% of their marketing budgets on sales literature fulfillment. And now...poof, at least in terms of what advisors rely on. Here's hoping a meaningful share of that spending on print has shifted to your digital budget.

What I wonder about is where asset manager apps would place on this list. It's a category worth breaking out next time.

More than half of surveyed advisors get at least 25% of their due diligence information from fund sites.

RTB’s take: Advisors who manage more money tend to rely more on wholesalers than on fund sites. But, the more money an advisor manages, the more they use the sites for research. Both of these would seem to make sense.

But if more than half of advisors get at least 25% of their due diligence done on fund sites, that means that a significant number of advisors are doing their due diligence on your firm and your products somewhere else. Are you plugged into those sources and how information feeds to them? Is someone checking on it regularly? These findings make it obvious that you can't afford to be disinterested about your firm's data and content syndication.

Advisors tend to use mutual fund Websites primarily to access core-level data on performance, holdings and risk metrics.

RTB’s take: No matter how imaginative you can get with enhancements to your site, here's a reminder of the highest value that a site can provide: As the product manufacturer, you’re recognized by advisors as having more product information than any other site is going to have. For many, it's the only reason to go to your site. Focus on improving the product information-gathering experience (e.g., how easy are your holdings to get to?) and all else will flow from there.

Asked to select up to five kinds of advisor-focused content that advisors found most valuable and relevant to their investment management and client service processes, 3% of advisors selected firm-created videos. (Detailed fund information, fact sheets, commentaries and fund research were what ranked highest.)

RTB's take: This has to smart, I'm sure. But, maybe it's time for you and your team to reset. Are the videos you’re producing truly advisor-worthy? Is it even realistic to be expecting advisors to regularly get their information from videos? Alternatively, what would you change in your approach if you instead optimized video on your site for the non-advisor visitors?

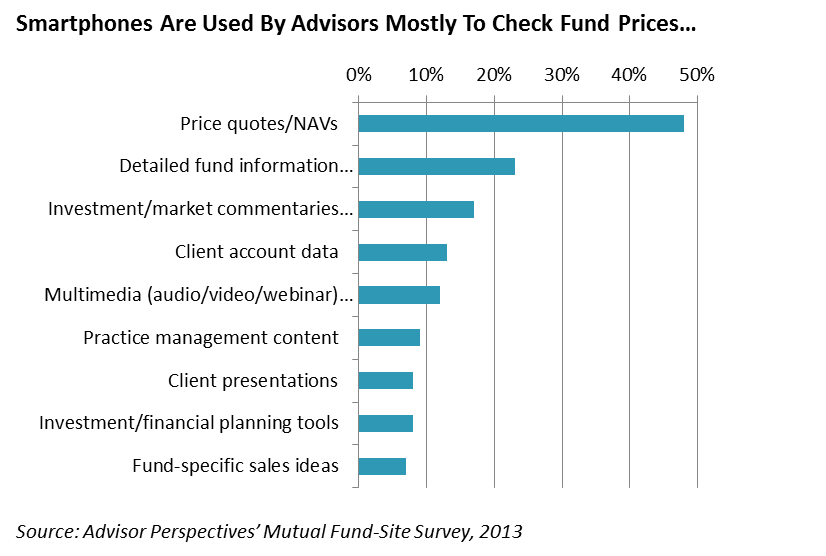

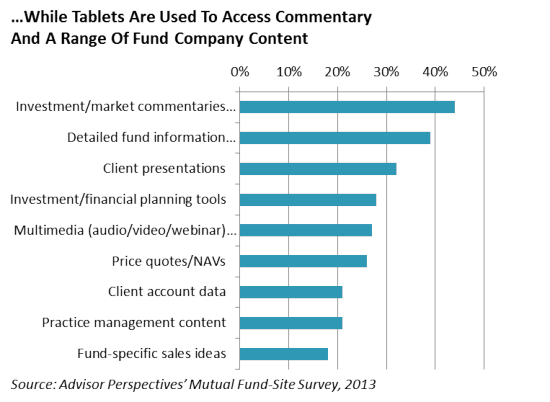

55% of advisors access fund company sites on a mobile device.

RTB’s take: Advisor use of mobile devices has been studied by a few surveys but never have we seen numbers on mobile advisors' access of fund sites. More than half of the group surveyed (55%) say they've visited sites while mobile, and more than one-quarter (26%) say they do it daily.

What are they looking at? "For everything except quick-hit tasks like getting price quotes, mobile users prefer tablets over smartphones," Advisor Perspectives reports. Below I've sorted the data to show the differences between advisor content consumption on smartphones versus tablets.

These findings provide added incentive for firms to be form factor-aware when developing and executing their mobile strategies. Dig into your Web analytics and create at least two reports—one for smartphones and one for tablets. You need to understand the differences between these two very different types of visits. Pay special attention to visits that start from links in emails.

"...Very few companies stand out as being the best. Of the top 20 largest mutual fund companies*, only nine were singled out by more than 10% of advisors as offering superior Website capabilities...This is an important wake-up call for fund companies."

RTB’s take: Important wake-up call? I have to part ways with Advisor Perspectives on this conclusion. I just wouldn’t go that far with the data that’s being shared. For starters, perhaps “the best” aren’t all among the top 20 largest mutual fund company sites.

My hunch is that most advisors who regularly use firm sites are generally satisfied. Of course, every site can be improved upon. But there’s no indication that the industry suffers from poor quality sites across the board. Advisor Perspectives has a database of 300,000 financial advisors, and thousands of them will respond to a survey on a subject they feel passionate about. If advisors' needs weren't being met, I think there would have been a stronger response.

But don't just take my word for all of this. If you're working on a fund company Website, the Advisor Perspectives research is a must-read point-in-time report on what's resonating and what isn't with a primary online audience.