A Closer Look At LinkedIn's Bid To Help Your Sales Pros With Social Selling

/ TweetOver the last few years, social network participation has yielded all kinds of data that’s been used for predicting and measuring effectiveness—and that includes on-the-job effectiveness.

Early on, we saw job postings requiring candidates to have a minimum number of Twitter followers. Some employers advertised for people with a minimum Klout score. Those requirements, meant to serve as a proxy for a job applicant’s social stature, have largely gone by the wayside. The measures themselves were proven to have little bearing on an employee’s capability, and some question the science behind influence scores.

I bring this up now as LinkedIn stages a full-court press with its Social Selling Index (SSI) and Sales Navigator product that promises to improve sales professionals’ effectiveness. If you’re a mutual fund or exchange-traded fund (ETF) company, it’s likely someone has reached out to your Sales management. Advisory firms, even more so, are being courted.

My sense is that there’s an enthusiasm about the SSI, in conjunction with asset managers’ keen interest in building out their overall presence on LinkedIn. After seven years of thinking about social for this business, I hesitate to say anything that could conceivably take away from the benefits that accrue from a systematic embrace of social interactions. I'm all for the listening, learning and connecting that LinkedIn enables, and provides extensive educational support for.

That doesn't mean that I don't have a few questions.

LinkedIn’s approach is different from basing hiring decisions on Twitter followers or Klout scores; its tool is designed to change behavior. But it’s similar in that it makes a correlation (LinkedIn activity drives sales effectiveness) that requires a leap, particularly when it comes to wholesalers calling on financial advisors.

A New Sales Performance Measure

LinkedIn describes SSI as “a first-of-its kind measure of your company’s adoption of social selling practices on LinkedIn.” The SSI formula was computed based on survey research conducted a few years ago and on behavioral analytics. The screenshot below from a 2014 presentation elaborates on how the formula was developed.

According to LinkedIn, adoption of social selling practices has four dimensions: the creating of a personal brand, finding the right people, engaging with insights, and building strong relationships. Each of these can be measured on a 1-25 point scale for a possible high score of 100.

I should say that each can be measured by LinkedIn based on social selling activity that takes place on LinkedIn.

You and I and everyone who has a LinkedIn profile has an SSI computed by LinkedIn, according to our performance on the dimensions, also known as the four pillars of social selling. I heard this at a Webinar I sat in on this week.

However, it’s not so easy to learn what your SSI is. Evidently, attendees to the Sales Connect conference last year were delighted to be welcomed with posters showing their scores, and I’ve seen a few LinkedIn Webinars that reported the SSI distribution of the Webinar attendees.

Otherwise, I think you need to talk to a sales rep. Also, the LinkedIn page where you can submit a request to get your SSI has an asterisked note that the SSI is for companies with over 100 employees and 10 sales reps, which should not be a hurdle for most of you.

This 2:30 video is a succinct explanation of SSI, starting with some data that shares what LinkedIn has learned from tracking its SSI over the last few years. Those with a high SSI score were promoted 17 months faster. SSI leaders have more opportunities per quarter and are more likely than SSI laggards to hit quotas.

It's Genius!

From April 2012 to July 2014, according to LinkedIn, the average SSI performance increased 87%—which LinkedIn attributes to increased participation in its four pillars. There was an average 26% increase in SSI by Sales Navigator customers within three months of their activation, according to the 2014 presentation.

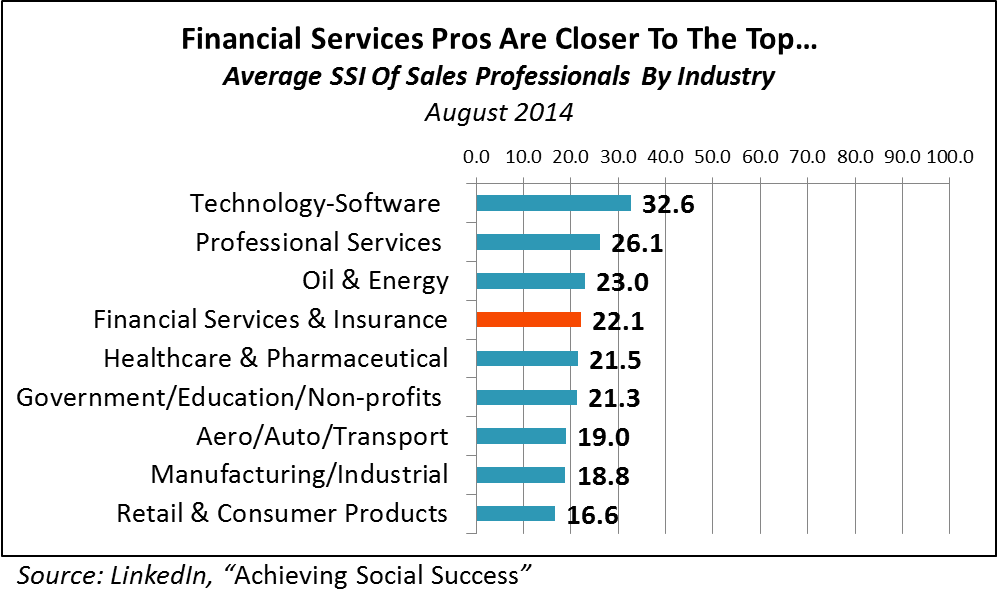

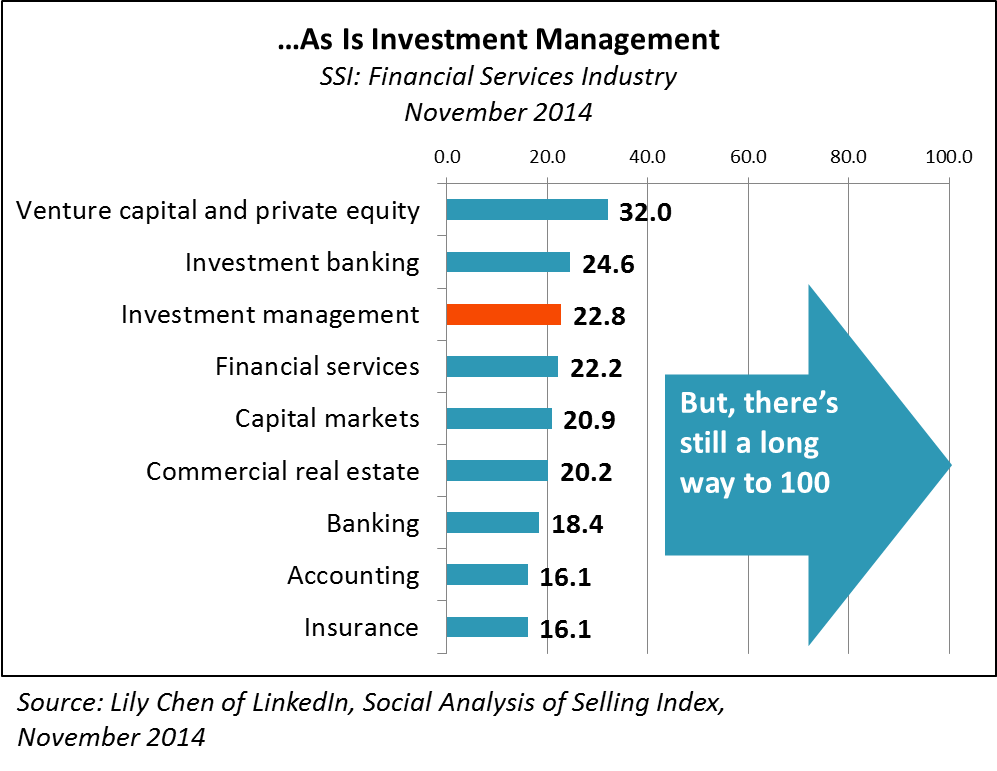

But as you can see from the all-industry and financial services charts below, SSIs today are quite low. Investment management sales professionals, even while near the top of the list, score 22.8 on a 100-point scale.

Marketers, before we go any further, let’s give it up for LinkedIn.

By developing the SSI benchmarking program, LinkedIn has documented a need that its Sales Navigator product can satisfy. They have found a way to drive adoption of a performance measure on which improvement is possible only by heightened use of their platform and their measurement tool.

Calling attention to these low scores suggests the opportunity ahead for those who commit to social selling (activities) and for LinkedIn, too. It's genius!

Success Stories

Just about a year in, there are some Sales Navigator success stories already being told.

The story most related to this business on LinkedIn’s case study page is about Guardian Life Insurance Company of America. A total of 250 agents took part in a pilot, growing their connections by 56%, performing 89,000 LinkedIn profile searches and selling insurance with a face value of $21 million. The PDF doesn’t comment on the agents’ SSIs and any movement there. Other firms including Bain, General Electric and PayPal also report success.

This is new and there are lots of questions not just about outcomes but implementation, which itself can be time-consuming and expensive for regulated investment firms. The Webinar I attended this week was co-hosted by Socialware and LinkedIn Sales Solutions, walking through some of the concerns (and available solutions). Here's the link to the replay, which I recommend you watch.

My great fascination with this program centers on the following:

- Better rev up the engine. A heightened focus on sharing insights and building relationships within LinkedIn is going to mean much more activity aimed at the finite group of advisors, consultants and others who play a role in choosing and using investment products.

Activity does not always translate to relevance, let alone effectiveness. Expect added pressure from your Sales partners to produce content and messaging that will help them achieve a healthy SSI.

- A LinkedIn skew. As I understand it, the value of Sales Navigator is not just in the prospecting support, it’s in the management dashboard that enables trend analysis and coaching for social selling behaviors. Does this mark the beginning of a blend of in-house and outsourced sales performance evaluation?

It will be interesting to see how firms factor in the SSI with other performance measures as tracked by their CRMs. Will the availability of such a measure from LinkedIn and not from Twitter or Facebook (for advisory firms) result in a LinkedIn overweighting?

That would be a shame in my opinion. Twitter offers ample opportunity for friction-free interaction with advisors that could lead to off-line follow-up. I'd hate to see Twitter overlooked as wholesalers are increasingly empowered to establish their own social presence.

- Company-level data. LinkedIn is the financial advisors’ preferred network for the connections they can make, and asset managers gravitate to it for the visibility in front of both advisors and business professionals.

Enhancements made over the last few years by LinkedIn have supported opportunities to raise individual and brand awareness. Finding and connecting with individuals happens via powerful search filters that take advantage of how the collected data is architected.

What we don’t hear about anymore is the data that LinkedIn is collecting on companies. Do you recall the company profiles that were once published as a roll-up of all the individual profile activity? Below is a screenshot of the detail of a Google profile from the March 20, 2008, post introducing it. Promotions and changes, most popular employees, career paths, median age, median tenure—it was all there and it was awesome.

I remember once talking to a client tasked with keeping track of the number of CFAs on her firm's investment teams. “Ask LinkedIn, they keep better records on your employees than you do,” I joked. That's still true, more so, but they've stopped publishing it.

Today LinkedIn knows the SSIs of every wholesaler who has a profile on LinkedIn, as low as they might be.

It’s inevitable (and a welcome evolution, I agree) that social selling will become emphasized at investment firms. Firms’ use of Sales Navigator, theoretically driving up SSIs, will assure that LinkedIn will have a reliable map of who the best social sellers/LinkedIn power users are.

Now that's business intelligence, the result of imposing a standard performance measure. I wonder how businesses will get at it.

- Publish the scores, LinkedIn! LinkedIn knows our social selling proficiency because it practices what it preaches—it pays attention to what members do on its platform. Given that our own account activity is the basis for the score, I wish LinkedIn would abandon its command and control approach to the data. There shouldn’t be any hoops for an individual member to have to jump through to see his or her score.

I stand on principle on this, by the way. I harbor no illusions about my own no doubt anemic social selling score. But if LinkedIn were ranking asset management marketing consultants (and maybe they are), I'd be that much more worked up about this.

By now, companies making money on user-submitted data is common practice. Google Analytics (although free to most) set a precedent for entrusting your business’ Website data to a third party in exchange for the utility of the tool. Your data is always available to you, as is the benchmarking capability.

LinkedIn’s data is the result of its members contributing to it. I think the scores should be viewable in each account’s settings for all membership levels.

And what are your thoughts?