Asset Manager Site Traffic Also On The Decline—What's Your Content Syndication Plan?

/ TweetIt's natural to want and expect the traffic on your mutual fund or exchange-traded fund (ETF) Web site to grow. But let's take a look at three data sets that suggest that you may need to reset what constitutes success for your Web strategy.

#1 Traffic is declining on the large well-trafficked brand sites.

A couple of blog posts have been documenting this lately. Go to a Digital Buzz blog post to see declining traffic patterns since 2007 of ESPN.com, eBay.com and Dell.com among others.

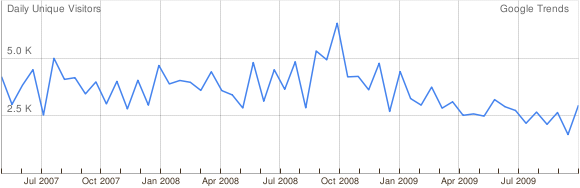

In the asset management vertical, look at traffic to Morningstar.com.

#2 Traffic is declining on asset managers' sites.

It's hard to imagine a year when there would be more interest in the market and economic commentary and fund performance data published on investment manager sites. In fact, there was a spike when we first looked at traffic in our special report last November (see SPECIAL REPORT: The Effect of the Market Meltdown on Traffic to Top Mutual Fund, ETF Web Sites) and you can see the spike in the charts below.

But it’s time for a reality check: The downward trend of traffic to asset management sites since 2007 is tracking with other brand sites.

Below we’re showing screenshots from Google Website Trends (click on the images to go there). But similar results are available from Quantcast.com and from the professional version of Compete.com.

We've looked at all of the top 20 mutual fund sites and the top ETF sites. The iShares chart represents the best case—traffic in October of 2009 is comparable to May of 2007. But this is despite the increasing popularity of ETFs, iShares market dominance, retail investor ETF interest and iShares' creative and aggressive marketing, with another $60-$70 million announced to be spent in the fourth quarter. A marketer might have expected more than traffic on par with two years ago!

American Century Investments' traffic represents the steepest decline—and this despite its proactive communicating throughout the market and economic crisis. [Since posting this, we have heard from American Century that the Google data doesn't match its internal analytics. A company representative said the suggestion by the graph that there were no visitors from April 2009 to July 2009 is wrong. But American Century doesn’t dispute the general thesis and acknowledges an approximate 20 percent drop in site visits from 2007 to October 2009.]

Vanguard

Fidelity

American Funds

BlackRock

American Century

iShares

What's happening? As Digital Buzz wrote, “Doesn’t make sense, right? More and more people are connecting online, brands are spending bucket loads of cash on digital campaigns so website traffic should be the complete opposite?”

There seems to be consensus that what the brand sites are losing, the social sites are gaining. Also, brand content is being consumed off brand domains via RSS feeds and syndication strategies that distribute content to YouTube, Facebook and other social networks. Given that few asset management companies offer syndicated content, we’d argue that social sites are where your customers and prospects are going. And, they're going to bump into few asset managers there.

Mint

As a quick aside, previously we described Vanguard as this industry’s leader in social media. But we call your attention to Pimco’s effectiveness at offline content syndication—in the form of Bill Gross and a few other market strategists whose thought leadership unquestionably elevates the company’s brand. In a blockbuster year for bond fund sales in general and PIMCO in particular, what does it matter if Website traffic isn’t up?

PIMCO

#3 Social sites have cracked into the top 10 Investment and Finance sites, as tracked by Hitwise and published on MarketingCharts.com.

We saw Yahoo Message Boards crack the list for the first time in July and wondered if it was an anomaly. But it’s been part of the top 10 for the last three months, taking the place of Vanguard.com in September.

So…there is something here.

It's easy to understand the general preference for sites where there are obvious signs of life—i.e., posts from today, interactions between visitors, fresh content posted hourly. Look at your site and look at Mint.com. Look at the calculators you offer and look at Simplifi.Net.

Look at your advisor site, bat away the cobwebs and put yourself in the advisor’s place. How much time would you be likely to spend there versus on Bloomberg, FinViz or on a brand new site Kapitall.com—or in your own self-built Twitter stream?

Some are proclaiming the destination Web site "dead." It isn't, of course, as only your site can be the authoritative source of corporate information. Because other sites won’t necessarily want it all, your site may have the most extensive information about your products, your news and your people. Your company will need to continue to maintain a contemporary, current site.

But what must die—and it may fall to you to drive the stake in its heart—is the belief that your company will remain relevant communicating only on your own site. That is not a sustainable strategy and now, especially in the course of your planning for 2010, you have to face it and then help others understand the consequences. Your company’s growth depends upon you meeting and engaging others on others’ sites.

This has been a recurring theme for the year we've been writing the Rock The Boat Marketing blog (celebrating its one-year anniversary this week, by the way) but this time we especially mean it. Even if it means rethinking your Web strategy priorities, it's high time to figure out how to package up your content and take it on the road.

Related Rock The Boat Marketing Content