Asset Managers Dominate #FixedIncome Tweeting Post-Gross

/ TweetAfter this post, I’m going on a PIMCO/Bill Gross/Twitter diet, I promise. But, I was looking at some data this week that was too rich not to share.

First, the September 26 announcement that Bill Gross was leaving PIMCO to go to Janus spiked interest in “Bill Gross” as a search term but not so much fixed income. This is according to the Google Trends U.S. data shown below (click on the image to see the data more clearly on the site).

Interest in Janus was far above average search interest while still lower than "Bill Gross."

On Twitter, where Gross' early use of the @PIMCO account influenced how other asset managers began to use Twitter to deliver timely, relevant micro-insights (see post), the news gave a healthy bump to the use of the #fixedincome hashtag.

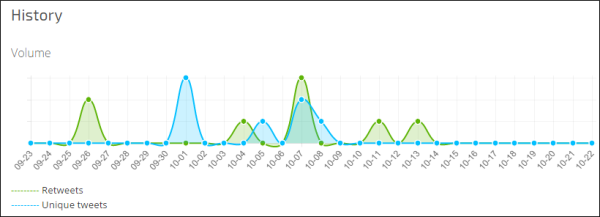

In the period between September 29 and October 22, 189 users sent 310 tweets with the hashtag, according to Keyhole.co.

The RiteTag graph below of tweets and retweets shows a rush to #fixedincome, relative to its average volume, that has since petered out.

Competing With Content

Here's what I was interested in. We saw some opportunistic fixed income advertising from fund companies in the days immediately following the news. And, of course, the email factories were working overtime. Did asset managers figure among those jockeying for what would be a burst of fixed income attention on Twitter?

Why yes, they did. The screenshot below from Keyhole.co shows the 32 accounts that used the #fixedincome hashtag most frequently. Twelve belong to asset managers, with @FidelityAdvisor, @NuveenInv, @WFAssetMgmt and @PutnamToday four of the top five accounts. Other firms participated at a lower level.

In all @FidelityAdvisor sent 37 #fixedincome tweets, most in support of Fidelity Advisor Total Bond Fund.

@BlackRock takes the honors as the account producing the top #fixedincome tweet (shown below), drawing 18 retweets and 38 favorites.@FTI_US, Putnam and @HartfordFunds were #2, #3 and #4 ahead of @SquawkBox. Sweet.

An investor's dilemma: Net worth and liquidity up, but #fixedincome market slowing down. What to do http://t.co/EnmfOdKmsk

— BlackRock® (@blackrock) September 30, 2014

Everybody Gains

What did the news do to @PIMCO’s enviable follower count? It's happy news all-around.

After a dip—there’s likely some correlation between fund flows and Twitter followers—@PIMCO is back on the rise again, according to TwitterCounter.com.

Meanwhile, @JanusCapital experienced a growth spurt in followers, although still trails @PIMCO by about 174,000.

You Got This

There are very few lightning-in-a-bottle moments for mutual fund and exchange-traded fund (ETF) companies using social media. There’s been no equivalent of seizing the opportunity of a dark stadium to promote dunking an Oreo cookie and watching the Twitter account grow by thousands overnight, for example.

But communications windows open and close on Twitter, and there can be opportunities for alert and agile investment brands.

On this single hashtag over the last four weeks, more than a dozen fund companies showed up and dominated in a way that rarely happens elsewhere online. (Unfortunately, paying for placement is the only way for many firms to get on page 1 of search rankings of key terms. Other brands got to most of the premium terms first and they’re not budging. See post.)

For some perspective, fund companies use other hashtags and many to a greater extent. Event hashtags get lots of pick-up, as Morningstar's Leslie Marshall has documented. And, it’s not as if @BlackRock hasn’t been retweeted 18 times before—its maximum is 155 RTs.

Still, this was a collective demonstration of the communications possibilities for asset managers:

1)using somebody else’s platform

2)and a lightweight, quick turnaround medium

3)to access an "audience" that others helped build and maintain

4)without being constrained by a frequency cap (i.e., Fidelity could have never sent 37 emails in the same time period)

5)to be relevant on a topic

6)that targeted others (financial advisors, media and other influencers) had hyper-interest in and were seeking commentary on.

For those of you in the mix, I hope something good came out of your participation. As for those of you still on the fence about Twitter, does this episode make you any more interested in chiming in?