"Astonishing" Advisor Research Suggests Necessary Changes To Mutual Fund/ETF Communications

/ TweetI was so eager to get at the recent Advisor Perspectives/Inside Information research that I read the complete 65-page report on my 4-inch phone while sitting out in a cold car waiting for a Realtor to show my house over the weekend.

The conditions notwithstanding, I thoroughly enjoyed myself. “Investment Trends in the Financial Advisory Profession: Key Implications for the Investment Management Industry” lives up to its promotional email.

Authors Bob Veres (Inside Information) and Robert Huebscher (CEO of Advisor Perspectives) wrote a page-turner filled with some provocative ideas for mutual fund and ETF marketers focusing on the elusive RIA channel. The study is based on more than 1,000 responses from independent and dually-registered financial advisors to a September 2011 survey of readers of both publications.

My thanks to Huebscher for providing a review copy of the report. My intent with this post isn’t to skim the cream of what was learned. I want to respect the fact that the report is being sold. (Contact Sales@AdvisorPerspectives.com for an executive summary and more information.)

Rather, I call your attention to a theme underlying the report. The research points to a reversal underway in how the industry had been evolving prior to 2008. Since the financial crisis, independent advisors have begun to work differently and the information that advisors need and value from asset managers has changed.

Most Advisors Are Tactically Active

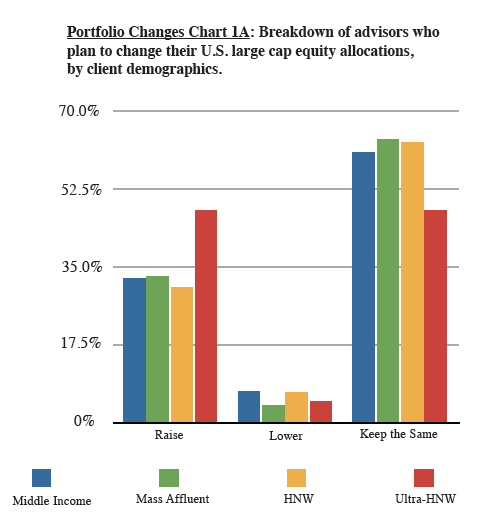

At the highest level, “one of the study’s most significant results” was the high percentage—83%—of advisors who planned to make a tactical shift in the allocations of their clients’ portfolios to asset classes or investment vehicles in the next three months. As an example, the graph below from the executive summary illustrates the change envisioned for large cap equity allocations.

What had been disparaged by “mainstream advisors” as market timing prior to 2008 is now common practice, the study notes.

A strength of this study for asset management marketers is that it consistently points out the implications of serving the information needs of “tactically active” advisors. Its insights should help marketing communications align their output with the information that independent advisors seek. (Also see an August 2010 Rock The Boat Marketing post "What One Advisor Wants From Asset Managers.")

What’s more, the report says that its findings may suggest how other distribution channels will be selecting and managing investments in the near future.

Investment Screening Based On Data

In the decade or so leading up to 2008, firms’ research analysts increasingly relied upon models to build recommended fund lists and as advisors heightened their reliance on that due diligence, quantitative values—funds with at least four or five stars from Morningstar, Morningstar style boxes, assets under management, expense ratios, etc.—were used to screen the contenders from the also-rans.

While few RIAs have home office support in the form of analysts and approved lists, they earned a reputation for being even more quant-based and for doing their own mad number-crunching to evaluate funds.

One result, noted by the research: 95% of all mutual fund inflows can be attributed to a Morningstar star rating of 4 or 5.

As a digital marketer, I’ve cheered the use of data-driven screeners, often delivered via the Web. They are an objective way of surfacing funds that might otherwise not be considered. Definitely an improvement over a focus fund list that was the result of a non-transparent business agreement between a national account and an asset manager.

However, in that screen-reliant New World, many of us wondered about the future value of brand and other communications, whether in introducing a new or different (translation: doesn’t fit in a style box) mutual fund or trying to build institutional awareness.

A Shift Toward The Qualitative

But the market meltdown of 2008 has prompted a change that's underway, according to what this research is reporting. The data suggest that independent advisors are emphasizing more qualitative factors. “Raw performance” continues to be important, the report says, but in the context of investment diversification and correlation. And, advisors are doing their own evaluations of a manager’s investment process and those evaluations are ongoing.

What is the most important investment characteristic when choosing investments for a client’s portfolio? A manager’s investment process tops the list of advisor survey respondents, as shown in the pie chart I created below. The Morningstar rating is dead last.

“Fewer than 10% included the Morningstar star rating among their top three fund selection criteria, and 33% ranked it last. Only 18% indicated that a fund's track record was their most important criteria; 44% included it in their top three. Just 39% counted a manager's track record among their top three criteria.”

The finding “that fewer than 50% of advisors in the 2011 sample ranked a fund's investment performance, or the manager's performance, as one of the most important criteria for selecting a mutual fund for client portfolios” would have “astonished” an observer just four years ago, notes the report.

Time To Rethink The Fact Sheet Template?

Consider this report and then consider the most basic of your product communications: the fact card or fact sheet.

One of the appeals of digital communicating is that routine updates can be templated and the data refreshed in an automated way. Mutual fund and ETF product communications especially lend themselves to a systematic approach. It’s not exactly set it and forget it, of course, because of fund events and disclosures that evolve over time.

But the elements of a fund sheet are fairly static, aren’t they? The Growth of $10,000 mountain chart (requiring a lot of space!), the Morningstar style box and star rating, lots of performance data and a paragraph or two about the objective or strategy. It may be time for a new template.

Note: According to the research, Morningstar may be ahead of asset managers in anticipating evolving needs. While it notes the diminishing relevance of Morningstar stars and style boxes, it says Morningstar's new Global Fund Reports, introduced in November 2011 as forward-looking analyst ratings, are likely to be relied upon by advisors for due diligence.

Focus On Reducing Downside Risk

Across their answers to multiple questions about investment vehicle and asset classes employed, frequency of portfolio changes, etc., the advisors make it known that their focus is on reducing downside volatility in client portfolios—and on staying on top of what’s happening that could threaten their clients’ exposure.

"Investing is fundamentally about risk management," the survey quotes one respondent as saying. This “seems to reflect the difference in mindset today from five years ago, when the response would likely have been: ‘investing is fundamentally about returns.’”

There are quite a few takeaways from the research (including some new ideas on RIA segmentation) but none is more crystal clear than this one. If your product communications are more about returns than risk management, they may need a post-2008 reboot.

Content marketing and social media weren’t mentioned once in the report (and yet I’m recommending the research anyway!) but they are implied. Advisors care vitally about your money managers’ process, especially in the “go anywhere” funds they are more likely now to embrace, according to the research.

To satisfy advisors' continuous need for information, today’s asset managers need more than run-rate product communications and well orchestrated presentations. They need to be visible and in the mix with real-time interpretations and analyses.

Finally, this report provides reason to be optimistic if you’re marketing a small or new asset manager. Take pains to explain your value proposition and your process, make sure others are aware of it and your prospects may be good.