Bandwagon Schmandwagon—Hooray For The Asset Manager Ice Bucket Challenge Videos

/ TweetThe Ice Bucket Challenge videos in support of donations to the ALS Association have been circulating all summer, and plenty of observers have copped a sort of bored-with-it-all attitude.

But I’ve gotten excited about things much less fun and engaging. I’m not going to restrain myself on this, not on the occasion of the investment management industry arriving (if characteristically late) to the ALS challenge to raise money to find a cure for amyotrophic lateral sclerosis (ALS), aka Lou Gehrig’s Disease, and help fund care for those suffering with the disease.

I am a sucker for humans stepping out from behind company logos, taking part in what’s important to others—and on others’ timelines—and specifically supporting worthy causes. Although the challenge was originally presented as an alternative to donating money, I would think that donations accompanying the drenchings would be de rigueur from participants in this industry.

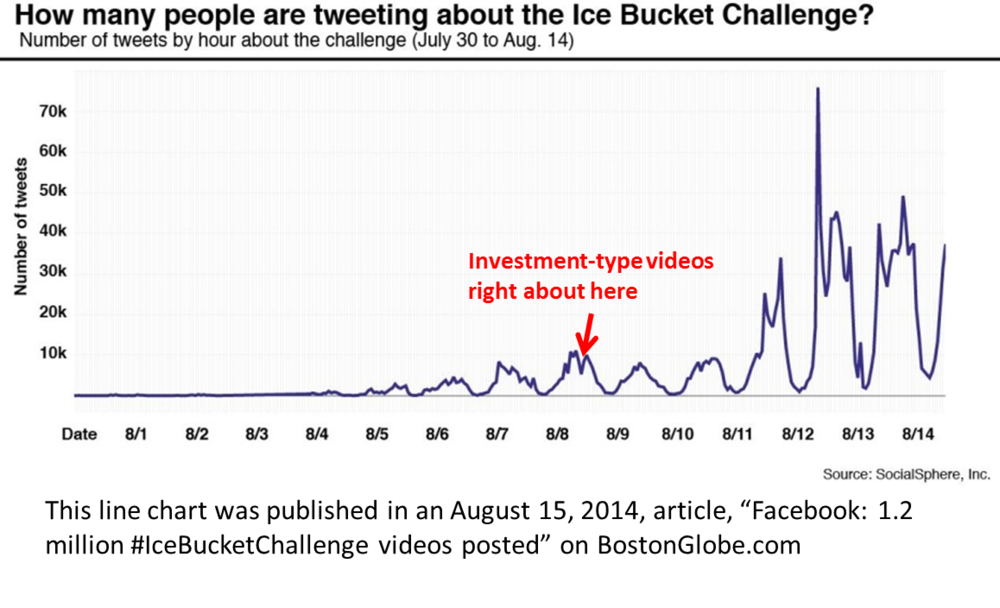

Over the weekend, I came across a Boston Globe report that tracked mentions of Ice Bucket Challenges on Facebook and Twitter, including the accounts responsible for driving the most attention. It’s quite a comprehensive analysis, but I wish someone would plot the spread from industry to industry.

(If the videos were being posted to LinkedIn, this kind of a network map would be a cinch. LinkedIn is too serious for hijinks, unfortunately.)

As shown to the right, Wikipedia organizes its list of Ice Bucket Challenge participants by industries, but Financial Services let alone Investments have yet to make it on the list.

The phenomenon, which the Boston Globe traces to starting in earnest in June on Facebook, seems to have been picking up speed in this industry in the last few weeks of August.

The first investment-related challenge video I remember seeing was from LPL CEO Mark Casady on August 8, just a few days prior to the start of the LPL Focus conference. Click through the tweet to see how much people liked it.

The first investment-related challenge video I remember seeing was from LPL CEO Mark Casady on August 8, just a few days prior to the start of the LPL Focus conference. Click through the tweet to see how much people liked it.

Done! #StrikeOutALS with the #IceBucketChallenge I challenge @RJMGLENLAKE @ConciergeWM and @waynebloom pic.twitter.com/AE1MLx6oXR

— Mark Casady (@MSCasady) August 8, 2014

Videos from several advisors, mostly from the LPL conference, followed. Yesterday, Suzanne Siracuse, the publisher of InvestmentNews, published her bucket challenge video.

Are You Listening For Challenges?

Starting on Friday, I spotted the challenges spreading in all directions, just like you’d expect of something, well, viral. With this post, I'm giving in to an urge to try to aggregate the videos created by mutual fund and exchange-traded fund (ETF) firms. Together they present a view of you that the rest of us rarely get to see.

First are the people-to-people challenges.

In their videos, MarketWatch’s Chuck Jaffe challenged Vanguard’s John Bogle, and ETF Trends’ Tom Lydon challenged BlackRock’s Sue Thompson (see her response below) and Jim Ross from State Street. On Friday, Morningstar CEO Joe Mansueto challenged Ariel Funds' CEO John Rogers, among others.

(Picking up social challenges is just another reason to have a social listening routine in place.)

In addition, a search of the investment manager Twitter accounts I follow (see this post for how to do an advanced search) and scan of the mutual fund and ETF Facebook and YouTube accounts surfaced videos from firms themselves.

When you publish yours (or if you already have and I missed it), shoot me an email and I’ll add it to this page. I should note that even Wikipedia is trying to manage expectations—it starts its list with this line: "This is an incomplete list that may never be able to satisfy particular standards for completeness." That goes for this list, too.

What's Strategic About This?

“Pat, what are you getting all worked up about? What’s strategic about this?” an exasperated friend asked me yesterday.

OK, that’s a fair question and I don’t have an on-point answer. Just a few thoughts follow.

- Earlier I took a shot about asset managers being late to the phenomenon. But look at the Boston Globe charts. The tweeting and Facebook posting peaked on August 4 and today is August 25. The firm that’s able to rush through all the approvals, clearances and production issues to get this done is virtually showing off a capability and temperament that not all firms have. Oh and strictly speaking, if your firm or executive is issued a challenge, you have 24 hours to respond.

Related: Producing a fun video suggests that everything else is under control in your domain. If your second quarter factsheets aren’t out yet, you’re not going to make this a priority.

I’m a little late with this post, incidentally, because I’ve been waiting for State Street to post its video, which it did Friday afternoon. Check out how State Street gave early notice—starting on Tuesday that a video response from CEO Joseph Hooley was imminent. When you need to buy time, these kinds of tweets work, don't they?

@GraniteTelecom Bring it on. Anything for a good cause. Now to get our hands on a couple hundred buckets. #IceBucketChallenge #ALS

— State Street (@StateStreet) August 20, 2014

Weather report for tomorrow looks good. Not like a little rain would have stopped us. #IceBucketChallenge #ALS

— State Street (@StateStreet) August 20, 2014

Where there are buckets, there’s an #IceBucketChallenge. Video coming ... #GoingGlobal. #ALS pic.twitter.com/XmnpT5snBv

— State Street (@StateStreet) August 21, 2014

- If your firm’s style is to be buttoned up in its presentation and robotic in its communications, people will like seeing you this way. Unpredictability can be a good thing in a relationship. As a call to action, “donate” is a refreshing break from “download.”

- When interests align over a piece of online content, sharing usually follows. Investment company videos might expect to see their fair share of sharing from those who spot an investment executive getting drenched online and recognize this kind of activity is against type. It's impossible to resist watching no less than Mario Gabelli taking multiple buckets of water. Already, the sharing of the videos is off to a strong start.

- Activating one’s employees to amplify the brand messaging has been a focus for many brands for most of 2014. In this space, firms continue to work on developing the policies and procedures to enable key people to create LinkedIn profiles and share firm content, for example.

When it comes to social media and regulation, the fewer words used the easier it is to share—I’d look for a sharing bump from the loved ones and business partners of all the unnamed armies standing behind the speakers in these videos.

- These videos also give us a peek at investment personalities and brands interacting with one another or other brands. Two years ago, in my Content Highlights of 2012 post, I commented on the playful trash-talking that was taking place between the Oreo and AMC Theater Twitter accounts. At the time, I couldn’t envision how this kind of thing would take place in this industry.

Well…investment firm employees and firms have all kinds of business relationships, and it’s likely that these videos will be created in the context of those. For example, last week's DST video was created in response to a challenge from H&R Block. Again, it’s going to be near-impossible to map but it's fascinating to see the challenges materialize and from where.

Without further ado, here’s who’s throwing ice buckets at themselves as of the morning of August 25.

BlackRock, Sue Thompson (video posted on ETF Trends' YouTube page)

Mario Gabelli, Gabelli Funds

Legg Mason Dragon Boat Team (video posted on Legg Mason Facebook page—click on image)

Pinebridge Investments

Pinebridge Investments

Schooner Investment Group

With a pledge to donate $100 in the name of an advisor or the advisor’s firm if 1)they pledge to do the challenge 2)have already done the challenge or 3)will make a donation to ALS. The firm is committed to donate up to $10,000. For more see, the MFWire story. Click on the image below to go to the video.

State Street

Voya Investment Management