Before You Go All-In On Facebook

/ Tweet“We’re starting to think more seriously about Facebook…”

I’ve heard this more than a few times from firms over the last six months. Typically, the firm has excelled with something else social (e.g., blog, Twitter account or LinkedIn company page) and believes it’s ready for something more challenging while potentially more rewarding.

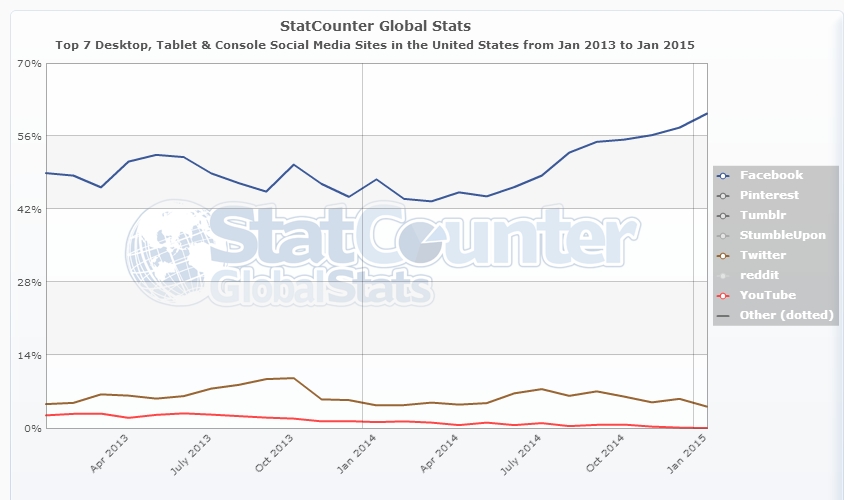

The size of the social network itself (890 million daily active users in December 2014), its 2014 surge and the engagement potential all make Facebook impossible to ignore if you’re a marketer in 2015.

Mutual fund and exchange-traded fund (ETF) marketers absolutely should consider participation (beyond the base camps many have already set up) on Facebook for their own strategies. Not knowing what your business or marketing objectives are, not knowing what your client composition is, not knowing what your content and other resources are, etc., I can’t go much further than this.

…Except to encourage you to temper your enthusiasm by drilling into Facebook’s sensational traffic and engagement numbers. Financial services, let alone business-to-business organizations, cannot expect the same pick-up that other industries famously experience.

For some level-setting, let’s first take a broad look at social media and financial services. Afterward, we’ll zero in on Facebook.

10 Finserv Brands Dominate

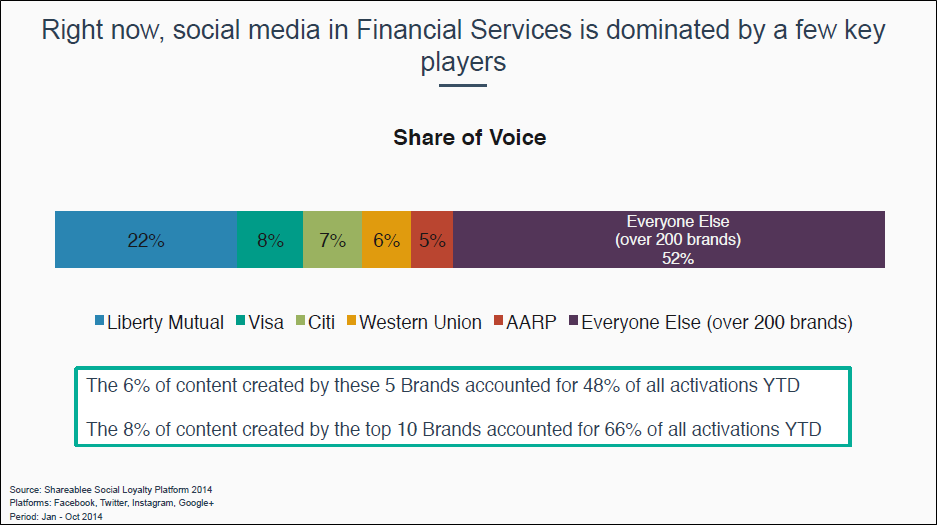

There’s no shortage of ebooks and whitepapers about social media and financial services, but this Shareablee presentation delivered at a State of Financial Services Webinar in late November is distinguished by the data it presents. Unfortunately, the Webinar isn’t available on-demand.

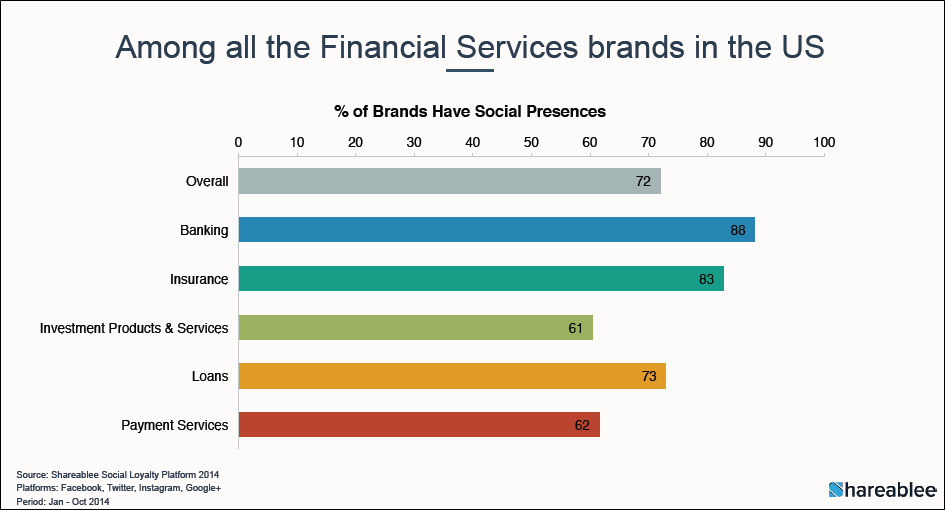

Shareablee takes care to report financial services subsegments, noting that the lowest percentage (61%) of Investment Products & Services brands have social presences. Banking, insurance, loans and even payment services brands are more active. Data quoted is from January through October 2014. Note that LinkedIn isn't a platform included in this report. The annotations on the following slides are from me.

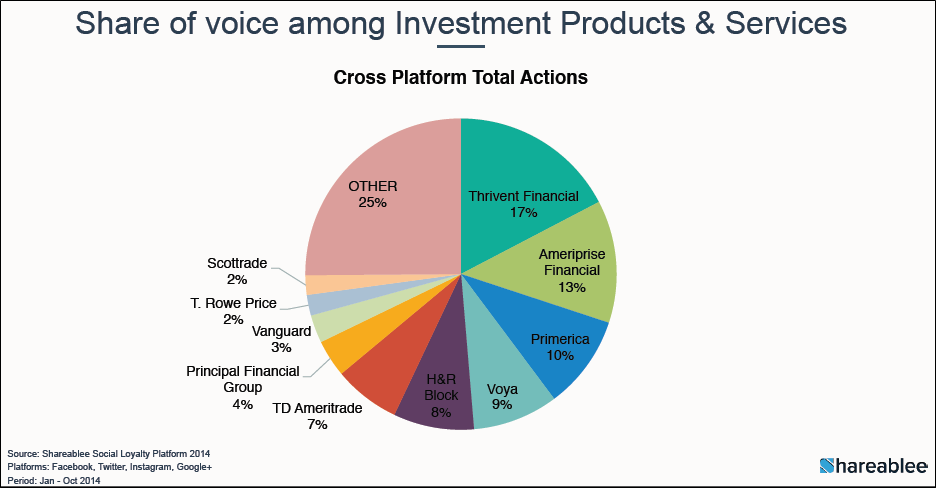

Within Shareablee's Investment Products & Services brands category are diversified firms and brokerages that are probably beyond your competitive set. They command the greatest share of voice.

Here’s the sobering slide: The top 10 brands dominate, representing 66% of all activity. If you’ve been successful, by your standards, with anything in social media, you are to be congratulated. It’s not easy to make an impact.

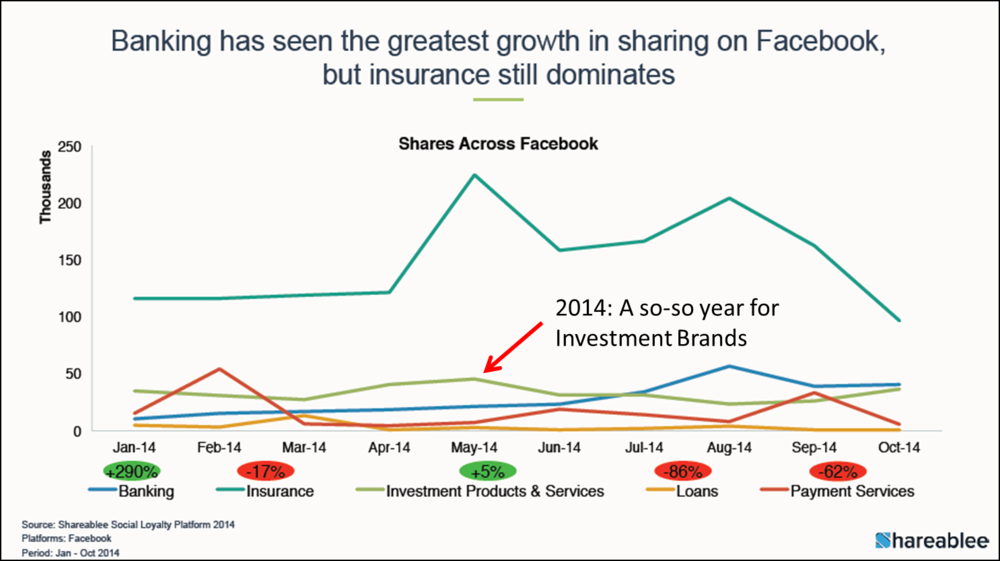

Next check out the Shareablee slide of Facebook sharing in particular. Despite all the hoopla about Facebook in 2014 and despite the pick-up of insurance and banking content, note the so-so sharing of investment product/service content.

This gets to the core content challenge of asset manager posts on Facebook. If you are not a Fidelity or Vanguard, if you don't sponsor community outreach programs (e.g., charitable benefits or sporting events), if you're new to engaging with a community and if the bulk of what you have to post is investment strategy and market insights, let’s be realistic about how much sharing your repurposed posts are going to get. How comfortable is a suit and tie at a barbecue?

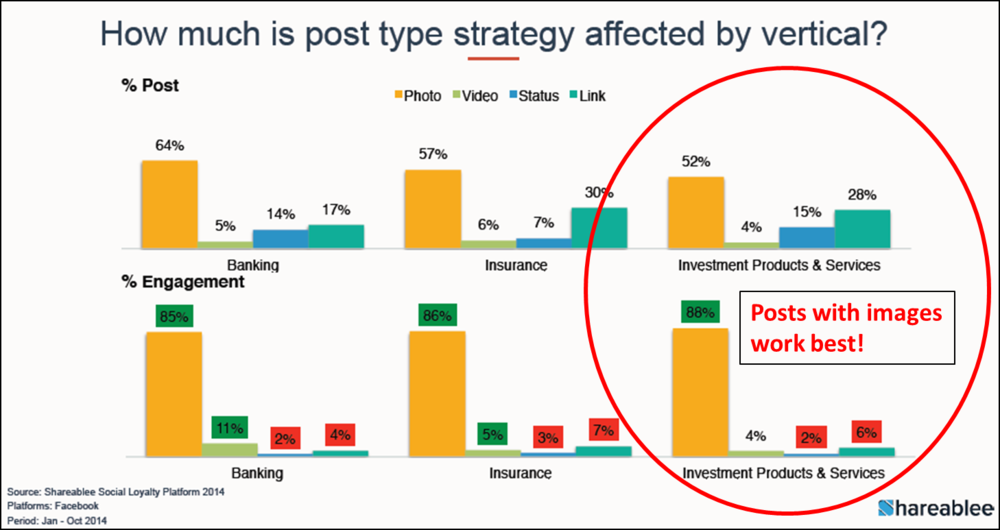

Minor digression: Before we leave the Shareablee deck, see the slide that shows the types of posts that people engage with. Across all financial services segments—but especially investment products and services—it’s photos! If you make just one tweak to your social strategy in all of 2015, please let it be to post more images.

Does Facebook Drive Traffic?

Why take on another social network and especially Facebook? To drive both brand awareness and Website traffic. So, does Facebook drive traffic? All of the above was a prelude to encouraging Facebook-aspirants to watch the following Whiteboard Friday video, published on The Moz Blog last week. A transcript is also available on the page.

It’s an engaging 17 minutes but if you’re short on time, here are a few highlights.

4:00: The Moz’s Rand Fishkin says the average page per visit of a Facebook visitor is about 1. “It tends to be the case that when you're in that Facebook feed, you're just trying to consume content, and you might see something, but you're unlikely to browse around the rest of the Website from which it came.”

This compares to the average 3-5 pages consumed by people who arrive directly on your site and to Google search-sourced visits (2-2.5 pages on average). Obviously, you’ll want check your analytics to see how your various traffic sources perform.

6:48: But, Fishkin notes, “Facebook's likes and shares are very indicative of the kinds of content that tend to perform well in search. So, if we can nail that, if we understand what kinds of content get spread socially on the Web and engage people on the social Web, we tend to also perform well in the kind of content we create for search engines.”

7:38: Fishkin begins his top 10 tips for Facebook optimization.

8:56: A social referral/introduction may lead to subsequent Website exploration. Here's a brief discussion of setting up analytics to track future visits from social referrals, and see this post for more.

12:43: Fishkin discusses limitations on the reach of brand content, a relatively recent adjustment Facebook made to dim the effect of what had been overwhelming brand content. The objective is to enable personal content, typically valued by users more, to resurface.

14:27: Facebook is difficult to "game" nowadays but it is still possible to “game human psychology,” says Fishkin. “If you can find the angles that people care about, that they're vocal about, that they get engaged, excited, angry, passionate, of any emotional variety about those things, that's how you tend to trigger a lot of activity on Facebook,” he says. Don't produce that kind of content yet? You'll need to.

If Facebook is a frontier you aim to settle in 2015, I'm rooting for you. Of course, an asset manager can succeed on Facebook. Just do your preparation, make sure you understand the level of new effort required, including some level of advertising spending, and be sure to track your results/effectiveness.