Commenting On Asset Manager Websites—And Some Said It Would Never Happen

/ TweetIn the brief history of blogs on mutual fund and exchange-traded fund (ETF) Websites, the stickiest point of contention between Marketing and Compliance has been the ability to accept and respond to comments.

Marketing: “But if we don't allow comments, how is this different from any other page we publish with market or investment commentary?”

Compliance: “Well, you’re the ones who want to call it a blog.”

Quite a few firms have opened their sites and blogs to comments. Such permissions have been accompanied by yards of moderation rules and disclosure but that’s to be expected.

Even in the absence of comments, there are more and more signs of a firm’s desire, or tolerance, for a two-way dialogue. And, the hint of the presence of a community can be found on domains controlled by asset managers.

I believe that firms’ generally positive experiences fielding comments on platforms they don’t control (Facebook, Twitter and LinkedIn) have led to less anxiety about the risk of comments posted on sites they can control. Moderation capabilities—including simply choosing not to allow the posting of a submitted comment—can go a long way. It’s also true that the firms are not the troll target that many feared.

Here’s a quick status report on how asset managers are inviting feedback on the content they publish. I should note that this review is happening just as a few well trafficked Websites such as Bloomberg Business and Copyblogger recently dropped comments. They say conversations belong on social media.

Go Big

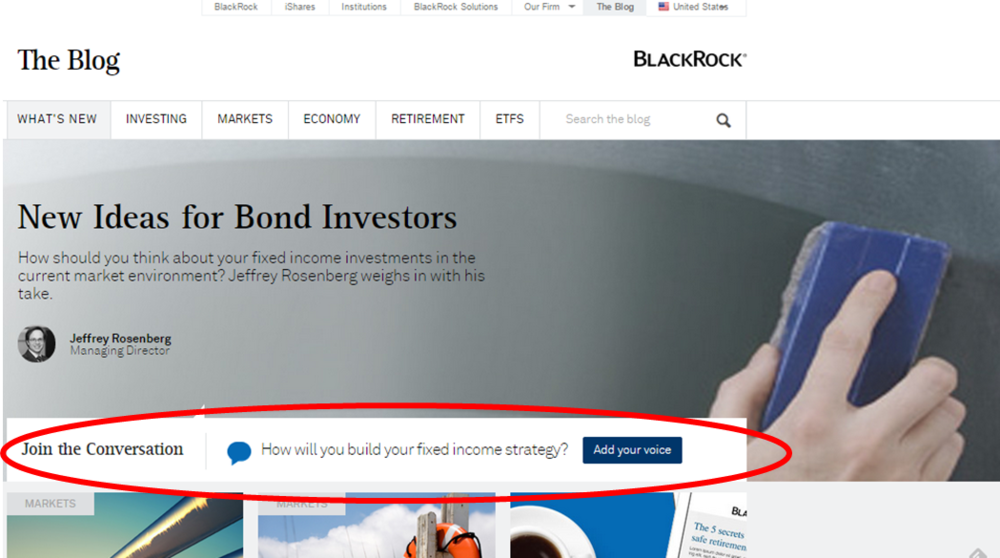

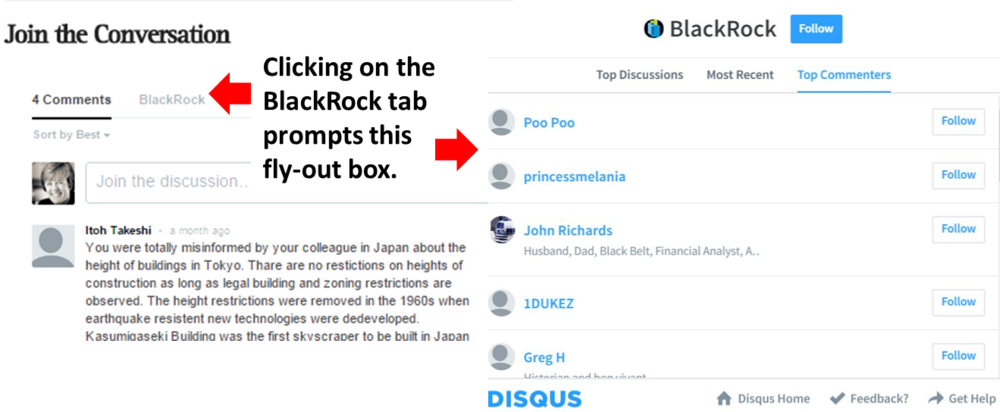

The BlackRock blog has started to embrace commenting in a big way. See the center bar on its home page which contains a question related to the most recent post. The Add Your Voice button links to a comment box at the bottom of the post. Clicking on the BlackRock tab prompts a flyout box showing rankings of all discussions and commenters.

Last September, we looked at BlackRock’s advisor community site, which was an ambitious undertaking. This is a natural extension for the firm to encourage blog visitors to “join the conversation” and, from the looks of it, relatively simple to execute using a Disqus integration with the WordPress blog.

Last September, we looked at BlackRock’s advisor community site, which was an ambitious undertaking. This is a natural extension for the firm to encourage blog visitors to “join the conversation” and, from the looks of it, relatively simple to execute using a Disqus integration with the WordPress blog.

Blogs that publish comments are some of the industry's best, including Pioneer’s FollowPioneer, Putnam’s Advisor Tech Tips, Russell Investments’ Helping Advisors, SEI’s Practically Speaking, Vanguard's blogs and Wells Fargo’s AdvantageVoice.

Social Sharing Icons

Simply put, if you'd like your content to be shared more on social platforms, your site or blog needs to offer social sharing icons. And, sharing can be a prelude to commentary that happens on those platforms. This is out of the moderation reach and, unless you have systems in place, out of the awareness of some firms.

I commented on the growing prevalence of the icons on mutual fund and ETF sites, including blogs, in a 2011 post. However, some firms continue to face Compliance resistance.

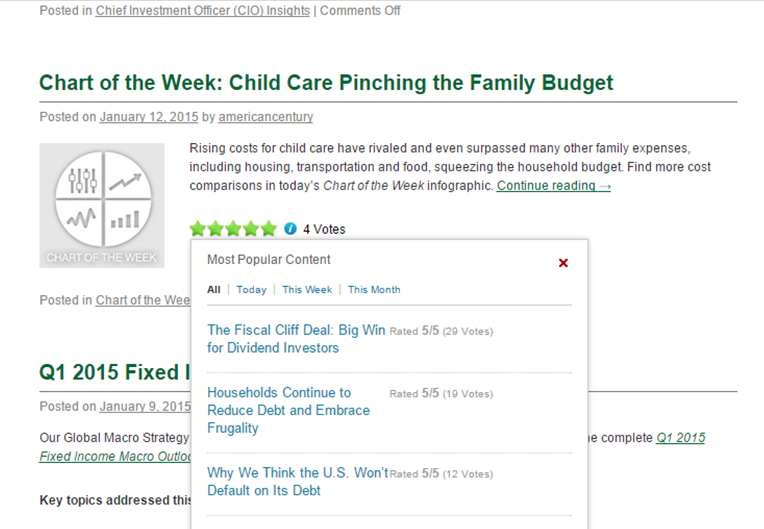

Comments may be turned off on American Century’s blog, but the social sharing counters and the popup of the Most Popular ranking support the user’s experience. The star ratings and total votes combine to provide an alternative form of navigation courtesy of previous visitors to the site—the reviews they've left behind identify what’s good on the site.

Making Thought Leaders Accessible

Making Thought Leaders Accessible

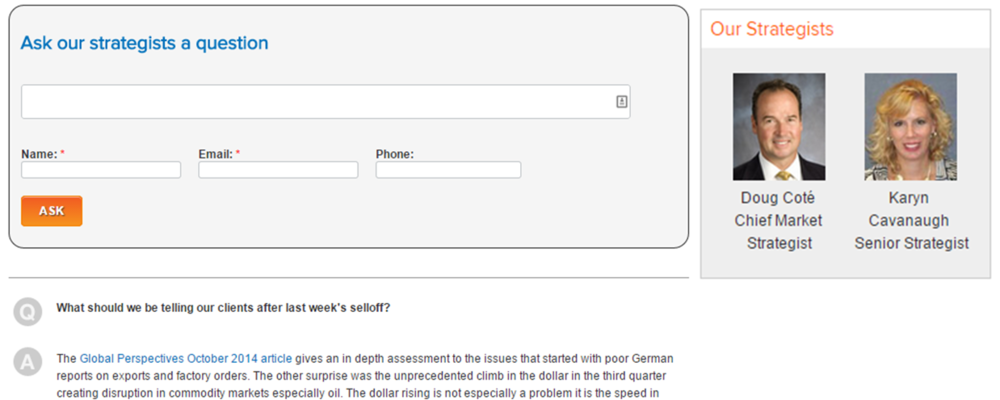

The Voya blog offers an Ask a Question feature. There’s none of the authenticity that comes with published account names, there's no date accompanying the question, the investment strategist who answered the specific question isn't named and there’s no opportunity for follow-up, which blog comments enable. It's a controlled yielding of the floor and the content focus to address what an individual reader is interested in. Despite its limitations, it has the effect of making Voya thought leaders accessible.

Not Now Doesn’t Mean Never

Not Now Doesn’t Mean Never

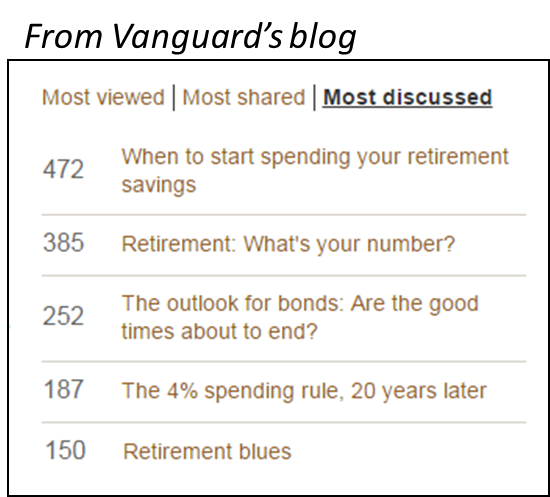

When Vanguard started blogging in 2009, I noted that comments were not accepted. It didn’t take long before comments were enabled and some visitors to the investors blog went to town. At the extreme, 472 comments have been submitted to a 2010 post on When to Start Saving Your Retirement Savings and it continues to top the blog’s Most Discussed ranking.

When Vanguard started blogging in 2009, I noted that comments were not accepted. It didn’t take long before comments were enabled and some visitors to the investors blog went to town. At the extreme, 472 comments have been submitted to a 2010 post on When to Start Saving Your Retirement Savings and it continues to top the blog’s Most Discussed ranking.

Vanguard accepts comments on its advisors and institutional blogs, but commenting there is much less common.

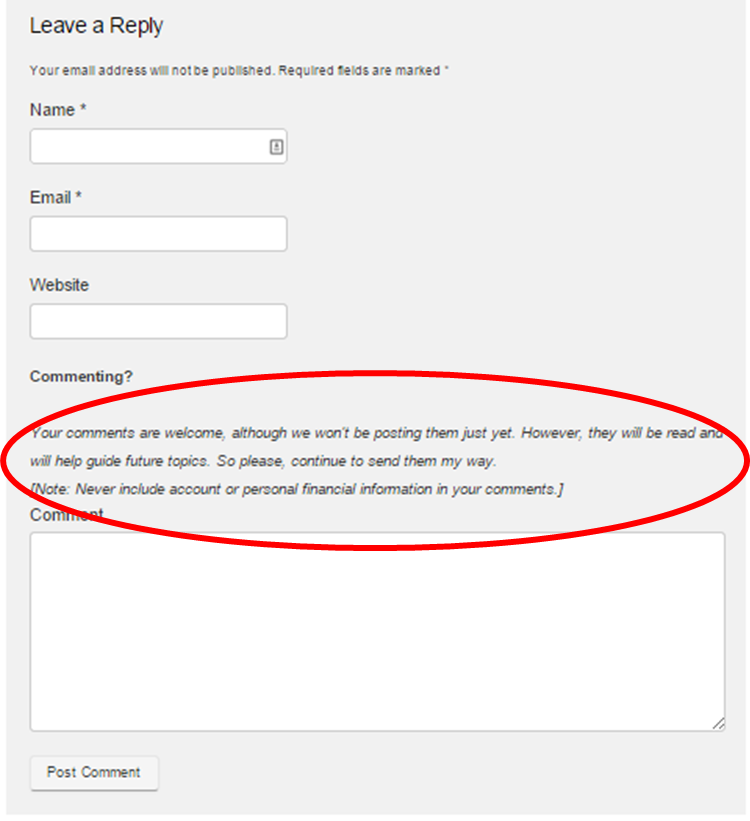

As shown below, Franklin Templeton's Beyond Bulls & Bears blog and a few other firms collect comments while acknowledging they won’t be posting just yet.

Twitter Widgets—Yes, But…

Twitter Widgets—Yes, But…

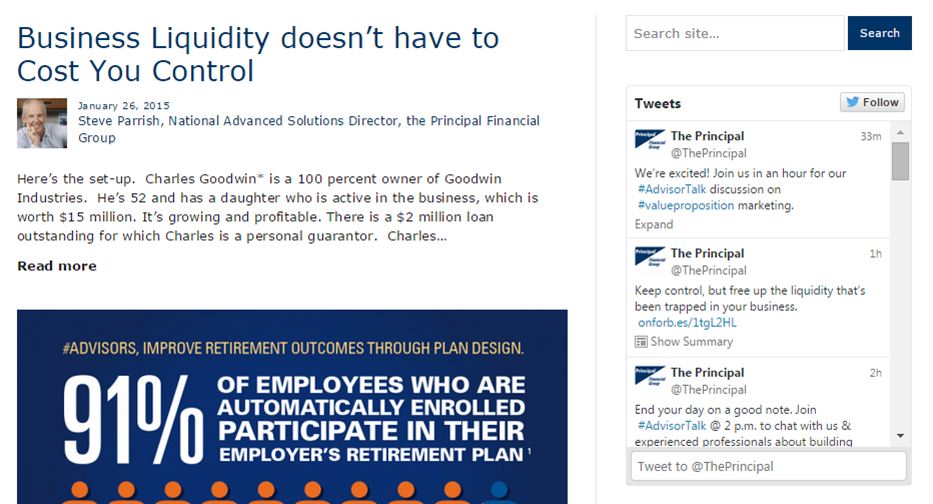

Several firms publish a Twitter widget on their blogs, which would seem to be a low-friction way of presenting commentary from other parties. However, this screenshot from the Principal blog is typical of all embedded tweets that I’ve seen published on asset manager domains. The feed is of the firm’s tweets only as opposed to all replies or mentions. This isn't surprising, there’s no telling what kinds of commentary would be published on an unfiltered feed.

But there's another consideration, too. A Twitter widget embedded on your own site can point visitors to content that you shared either on your site or off. By contrast, the interactions your account has with others would be less valuable and may be less effective in prompting people to follow the account. Even when configured to show just your account's tweets, though, the presence of a Twitter widget suggests the firm's participation in and even availability to the community.

But there's another consideration, too. A Twitter widget embedded on your own site can point visitors to content that you shared either on your site or off. By contrast, the interactions your account has with others would be less valuable and may be less effective in prompting people to follow the account. Even when configured to show just your account's tweets, though, the presence of a Twitter widget suggests the firm's participation in and even availability to the community.