Mutual Fund, ETF Sites Not #Winning With The Pinning

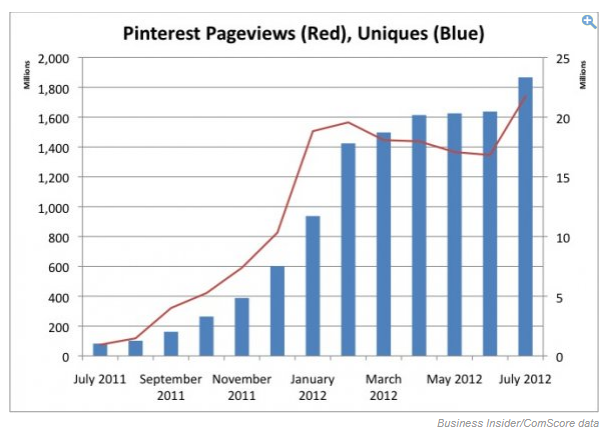

/ TweetWe’ve all heard about Pinterest’s unprecedented climb to the mainstream (to 23 million unique users by July of this year). It’s popular with an age group (66% of Pinterest users are 35 and older) and a gender (79% of users are female) that asset managers would like to get close to (data from an eMarketer report this week). And, it reportedly drives more traffic to Websites than ye old Yahoo.

Still and all, mutual fund and exchange-traded fund (ETF) firms have mostly sat out on the Pinterest image sharing phenomenon. The early success of the social network has been concentrated in the home and apparel categories, and it's not surprising that few investment firms care about Pinterest, let alone want to set up a shingle on the site.

If They're Pinning Bloomberg...

But, haven’t you been curious about whether, unprompted, people are finding and pinning images they like from asset manager sites?

Me too. So, about a month ago I created PinAlerts for two types of content publisher. One set of PinAlerts was for Bloomberg.com, CNBC.com and Morningstar.com. I just wanted to get a sense of the kinds of investment content that was being pinned. I also set alerts for a mix of fund companies, creating folders in my email program so the alerts wouldn’t overwhelm my inbox. While that was a good call for the Bloomberg alerts (see Bloomberg's pins here), the CNBC, Morningstar and fund company firm alerts have been just trickling in.

Here’s a list of the pinned content I’ve seen to primary domains—many mutual funds have microsites but I didn't check for them. Fidelity has the most pins as of this writing.

- BlackRock

- Dimensional

- Fidelity

- Franklin Templeton

- OppenheimerFunds

- Pimco

- T. Rowe Price

- U.S. Global Investors

The Pinterest activity is light, with a few dozen pinners taking part. The more graphic the firm’s communications, the more pins there are. For example: The screenshot below is from U.S. Global Investors' page.

The boost in site traffic, of course, comes from when other pinners begin to engage by liking, repinning or even commenting. There's not a lot of that. BlackRock's cost of inaction graphic leads in the category (27 repins, 10 likes and one comment), based on my review last night. Note that the interests of the pinners seem to suggest that it's being appreciated more for its design aesthetic than for its investment message.

Restricting Pinning?

None of the firms whose images are being pinned offers the Pin It sharing button on their Websites. Unknown is whether firms are restricting pinning of images from their sites. But I doubt it.

Beyond that, there isn’t much to say about this, my latest adventure into money manager social media surveillance. Maybe you’ll have more insight when you check out pins to your own site—just go to http://pinterest.com/source/yourdomain.com/. You might also set up a PinAlert to be notified when content is pinned on domains you care about.

What do you think? Will the pinning rage skip mutual fund and ETF sites altogether? Or, will it come as Pinterest attracts pinners with broader interests and and more graphics are introduced on more investment sites?