Putnam Social Media Research Provides Insights And Data To Slice And Dice

/ TweetEarly discussions about financial advisors’ use of social media gravitate to the same three questions, which I’ve paraphrased to capture a bit of the skepticism:

“Of course, they have a LinkedIn profile, but what’s social about that?”

“Well, they may have accounts but their Compliance departments don’t let them really do anything, do they?”

“Yes, but are ‘our’ advisors—you know, the ones with the assets—really using it? Really?”

With the research it’s releasing today, Putnam adds to the collective understanding of how advisors use social media as a marketing, networking and relationship tool. Some of the data aligns with other research (including the authoritative work done annually by American Century) and is unsurprising. At the highest level, 75% of advisors use at least one social network for business, and eight out of 10 name LinkedIn as their primary network.

But there’s also a lot that’s new here. I’m going to cherry-pick but encourage you to review the full results.

The "Putnam Investments Survey of Financial Advisors’ Use of Social Media" (see infographic, a link to the full press release will follow when it's available) was conducted by FTI Consulting in July 2013, based on a survey of 408 U.S.-based financial advisors. More than half (54%) of the respondents are affiliated with independent broker-dealers, 17% national broker-dealers, 13% regional broker-dealers. The others have insurance, bank and financial planner affiliations.

Most exciting for some of us is the data visualization capability accompanying the research. Putnam has published the data in a workbook accessible via a public (free) version of Tableau software. This enables users to view the data distribution and even do their own slicing and dicing.

“It's all about data discoverability, open-source data, and collaborative use of data. So, have at it,” Putnam Social Media Director Jayme Lacour told me.

The question never asked: Advisors on Google+

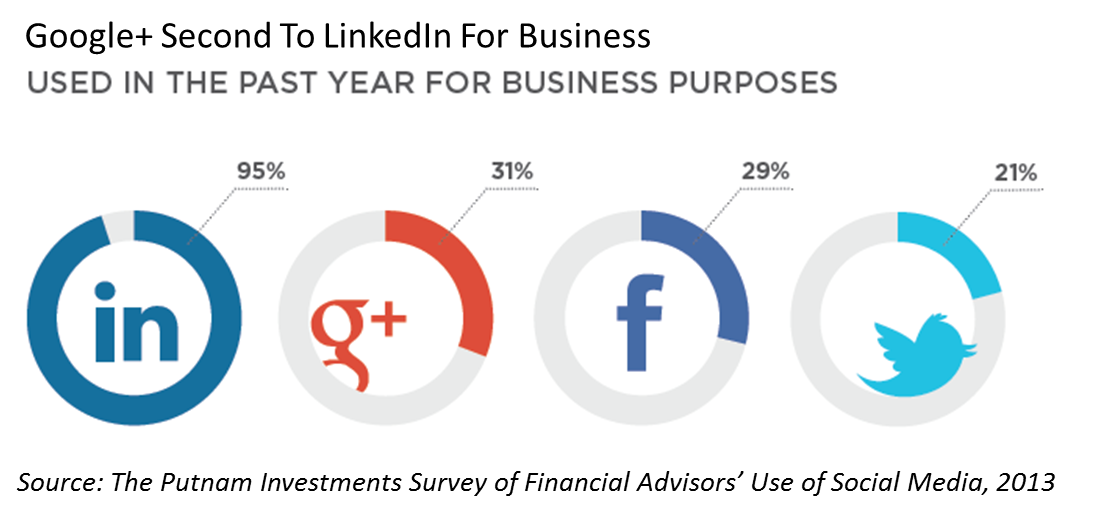

Before we look at how the Putnam research provides insights to the most frequently asked questions, I’ll call your attention to the data on advisor use of the sleeper social network: Google+. People rarely ask about Google+ and yet advisor use of it ranks much higher than most people would have guessed. Almost one-third of advisors surveyed (31%) used in it in the past year for business purposes; it’s second only to LinkedIn.

Overall, while LinkedIn is the most used social network, Facebook consistently ranks #2, largely in relationship management activities. The screenshot below is from the data viz page.

This data is reminiscent of similar questions that appeared in a previous FTI Consulting study done in conjunction with LinkedIn. The graph below is from the May 2012 Financial Advisors’ Use of Social Media Moves from Early Adoption to Mainstreamresearch.

These are two different surveys, but the dimensions are so similar I can’t resist comparing the findings and wondering whether a few differences reflect an evolution in the networks advisors prefer to use.

While the datapoints are different in the Putnam work, most of the order of the preferred networks is unchanged from the earlier research. Two exceptions relate to the prominence of Facebook as a means of enhancing current relationships and cultivating client prospects.

Twitter does not stand out in the Putnam research, except on a dimension that asset managers have keen interest in. Note that it is the preferred network for cascading thought leadership. That’s a much stronger showing than in the LinkedIn/FTI Consulting work a year ago when LinkedIn towered over all in that category.

Oh and elsewhere in the data you'll see that 58% of advisors say their usage of Twitter has increased in the last year, closely following 61% who report increased LinkedIn usage.

Q. “Of course, they have a LinkedIn profile, but what’s social about that?”

Take a look at the activities reported in the research and you’ll see that advisors who consider LinkedIn their primary social network are doing more than maintaining LinkedIn profiles.

The infographic reports on six activities but you’ll see a dozen total LinkedIn activities on the data viz page.

This may be the most encompassing look at advisors’ participation on LinkedIn. It was smart, for example, to ask whether advisors can access LinkedIn at work and whether advisors follow companies. For next time: What percentage are using the Contacts mobile app? What percentage are following the LinkedIn thought leaders? How many are customizing their LinkedIn updates? All have bearing on asset manager content marketing initiatives.

Putnam has more than research interest in LinkedIn. As you may recall, the firm broke new ground earlier this year when it empowered its wholesalers to engage with advisors on LinkedIn.

Q. Well, they may have accounts but their Compliance departments don’t let them really do anything, do they?

The screenshot above of advisors’ LinkedIn activities is from the intriguing Activities tab on the data viz site. On the page you’ll see a rich list of possible activities that advisors could and do engage in on the other surveyed platforms: Facebook, Google+ and Twitter.

Unfortunately, Putnam chose to report the data by advisors’ primary network. Given LinkedIn’s dominance in the survey, the result is that low levels of data are reported for the other networks.

Other surveys have asked advisors to identify a primary social network, too, but this is an artificial construct. In this case, it diminishes the value of the data that could be collected to report on what advisors do on all networks.

Proceed with caution and be sure to note the sample sizes when considering the Activities data that's being shared.

Also, Twitter gets short shrift in the list of surveyed activities. Following and maintaining Twitter lists are two activities to report on next time, for example.

Q. Yes but are “our” advisors—you know, the ones with the assets—really using it? Really?

This is the acid test for most mutual fund and exchange-traded fund (ETF) firms evaluating the opportunity today in social media.

Putnam’s work is not the first to seek to provide insight. When Accenture reported in March of this year, it surveyed 400 advisors including 250 brokerage/wirehouse/bank advisors and 150 advisors who were independent or represented a regional bank or insurance firm and reported very different results. According to its research, nearly half (48%) of financial advisors are using social media on a daily basis to interact with their clients—most of whom (60%) were reported to have assets of more than $20 million. Hmm, many found that hard to believe.

Putnam’s profile of The Social Advisor—which they defined as the advisor who uses social media on a daily basis—confirms the views of social media skeptics. Daily social media-using advisors look to be a little light in the AUM and in the average client portfolio, when compared both to the Accenture findings and to the characteristics of RIAs, as reported in Cerulli Associates' "State of the RIA Marketplace 2012." This is not an apples-to-apples comparison, note. Not all Putnam respondents were RIAs.

However, advisors surveyed report a return on the investment they make in social media as a form of connecting. Almost one-half (49%) of advisors say they acquired new clients through social networks and of those, 29% gained over $1 million in new assets, Putnam research reported.

And—in a move that might be most useful to broker-dealers and individual advisors—Putnam goes a step further and uses the data to map the states where the new clients and assets came from. The darker the blue, the more successful the social media participation. Sweet.