Reaching Advisors Via Gmail? Read This

/ TweetThe end may/may not be near.

Retailers and other heavy email users are reporting reduced engagement afterGoogle’s recent change to how it categorizes Gmail. Some are quite upset, going so far as to suggest that Gmail is "killing" email marketing.

In this industry, email is by far the most effective marketing communication, a point reinforced as recently as this table from the July 2013 Cogent Research*: Advisor Touchpoints™. Even so, my sense is that this industry is closer to the "The End Is Not Near" part of the spectrum. But, it is possible that your firm's email effectiveness will be diminished to some extent, thanks to the Gmail changes.

Are you using media lists to distribute marketing messages? This has bearing for them, too.

For Collecting 'Marketing' Emails

For background: Gmail is #8 among email clients. As part of the Google Apps suite, it has particular appeal to RIAs who have warmed to the idea of keeping their data in the cloud.

But, advisors of all stripes long ago decided that there are benefits to maintaining an email address for the purposes of collecting “marketing” (translation, sorry to say: non-essential) messages. Over the years, many gravitated from Yahoo! and Hotmail to Gmail as their preferred free email service. More often than not, it's a Gmail address that's used as a second address when advisors sign up today for asset management communications, among other online offers.

In other words, advisors have already siloed asset management communications from their primary email account's Inbox.

I was worried three years ago when Google introduced a Priority Inbox feature based on the Gmail user’s reading patterns. But now (starting in late May and continuing on a rolling basis that is believed to be complete now), Google is automatically categorizing email as it arrives.

Here’s the upbeat video that Google created when the tabs were announced.

This is a broadbrush treatment, and Google has yet to reveal the basis (algorithm) on which the emails are categorized. We're not likely to ever know.

It's A Tossup Where Mutual Fund/ETF Emails Go

Most asset management communications are sent on an opt-in basis. More to the point, few are promotional in nature. Global investment perspectives and half-price mani pedi offers don't have much in common. Unfortunately, Google is ruling otherwise.

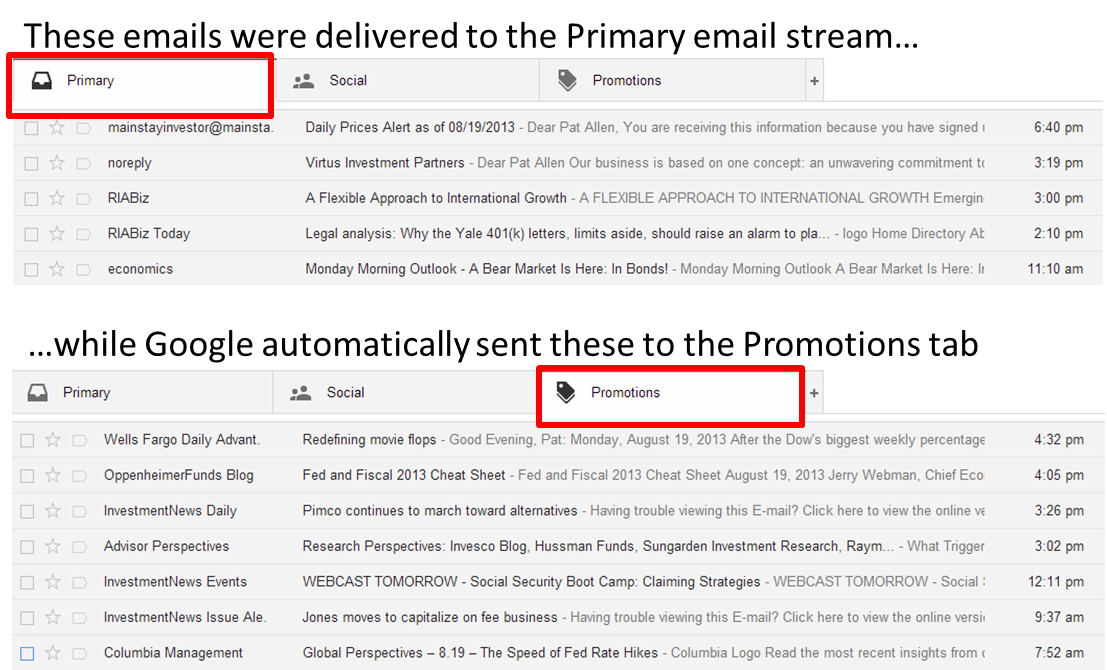

Over the last few days, I’ve used a Gmail address to subscribe to many mutual fund, ETF and investment media newsletters and the early results are not encouraging. The screenshots below illustrate the problem with representative emails received yesterday.

Most of your work is showing up in the Promotions tab versus the Primary stream. Google's algorithms notwithstanding, to the naked eye there seems to be no rhyme or reason to the categorization.

The most promotional email in the set is the first RIABiz email in the Primary tab, carrying a sponsored message from T. Rowe Price. The content and tone of the emails flagged as Promotions are different in no perceptible way from the emails that made it into the Primary stream. You can't tell from the return address ("economics"), but the last email in the Primary stream, by the way, is from First Trust. Personalized emails show up under both tabs.

By comparison, all of the emails shown above arrived directly in my Outlook account, none was stopped by its industrial strength SPAM filter.

Remain Vigilant

By definition, emails relegated to the Promotions tab will get less attention than email included in the Primary stream. What's an asset manager email team to do? Here are a few suggestions:

Size the problem.Look into how many Gmail addresses you mail to. Maybe this is not your firm's problem. Another relevant consideration is where the Gmail is being read. The tabbed Inbox is available only in the Gmail webmail client and in official Gmail apps for iOS and Android. One recent study found that only 19% of Gmail opens actually occur in official Gmail.

Monitor the effect. Create a report that segments only the Gmail recipients on your email list, and track the open and clickthrough rates over time. If you use MailChimp, by the way, you’ll want to read "Gmail’s New Inbox Is Affecting Open Rates." Also, ReturnPath offers a Gmail Tabs analysis for brands. Unfortunately, the benchmarking data provided is of limited value given that Banking is the closest it comes to investment companies.

Be proactive. Prepare and send an email that shows Gmail-using advisors how to move your emails out of the Promotions tab and into the Primary tab. This MailChimp post includes the explanation you’ll need. There's nothing to it. But, be realistic about how many advisors will respond to such a plea. You might think about enlisting your internals in the crusade.

Let's keep an eye on this.