What's New On Mutual Fund, ETF Websites

/ TweetI wince every time I see how prominent “Social Media” is in the tag cloud on this blog. There’s more to digital marketing strategy than just social, obviously. Let me make up for it a little today by sticking closer to home and calling your attention to some progressive information design showing up on a few mutual fund and ETF Websites.

J.P. Morgan Funds' Insights

The design of J.P. Morgan Funds' recently launched Insights page fully embraces the value of the economic and market commentary the firm creates. This screenshot shows just part of the page, be sure to follow the link to see the range of content available in pdf, video and audio form.

Of special note: See the quick access provided via fly-out menus to synopses of sections of the weekly economic update. And, the Insights Finder dropdown menu in the right-hand corner offers content navigation by topic, media type or thought leader.

Legg Mason Thought Leadership

One of the features that users like so much about Pinterest, the social site that has grabbed lots of headlines this year, is its grid design. (See this Mashable post with the over-the-top headline "How Pinterest Is Changing Website Design Forever.”) You can see some similar design elements in the Legg Mason Global Thought Leadership site.

See how each element is a block, and the content is displayed in some order other than reverse chronological. The offer of an RSS feed based on the most popular content is also a twist on the more conventional chronological approach. However, in both cases, as a user, I’d like to see the date associated with each item. And, something was wrong with the RSS feed when I tried to subscribe yesterday.

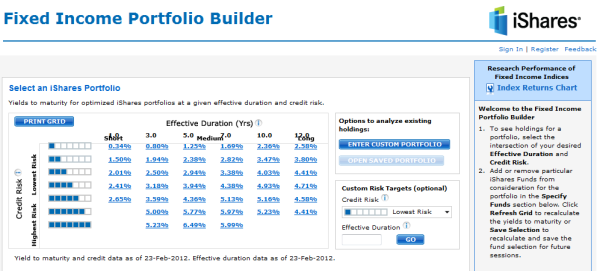

iShares' Fixed-Income Portfolio Builder

Putnam’s FundVisualizer raised the bar almost a year ago by accommodating the comparison of just about every mutual fund and ETF. For years, fund companies had kidded themselves about the utility of online portfolio tools that compared only the products they manufactured. Few if any advisors use just one "fund family."

The iShares Fixed Income Portfolio Builder analyzes just iShares ETFs. In that respect, it’s limited. Still, you need to check out how this tool works, enabling users (it’s not behind an advisor log-in, by the way) to search for income solutions by selecting credit risk and duration.

Many marketers working on asset manager Websites give cursory attention to functionality supporting fixed-income funds. While nobody seemed to notice prior to 2008, advisors today have to work the fixed-income side of clients' portfolios just as hard as the equity portion. What more could your site do to help?

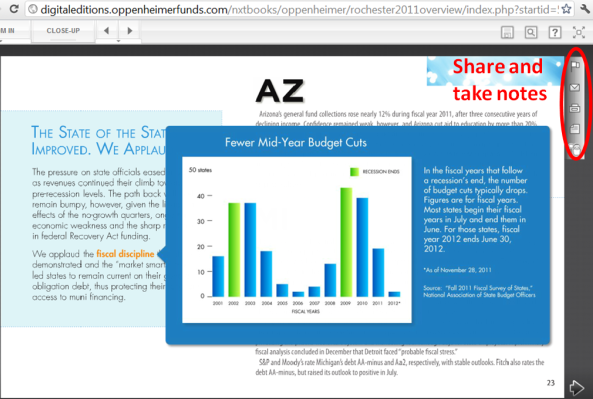

Oppenheimer Funds/Rochester's Digital Overview

Oppenheimer Funds/Rochester took its annual overview a different direction this year. The document starts on a Web page whose table of contents launches a digital edition.

I have been lukewarm about these in the past because they seemed to be more about the interactive technology than about what tended to be mostly static content. Also, other iterations I’ve seen have offered lots of information but all of it contained and within a proprietary format. My bias is always in favor of Web pages that search engines can spider and index and searchers can find.

In this Rochester example, a menu in the upper right-hand of each page enables Rochester’s content to be shared at a page level via Facebook, Twitter, LinkedIn etc. According to the Nxtbook documentation, an XML file containing all of the content can run behind the digital edition, and that's what search engines index. And, you can do something with this that you can't do with a collection of Web pages: save notes to the document.

This is an interesting solution if you have a rich story—Rochester uses graphics, video and audio to elaborate on points made in the text—to tell and you expect your readers to be engaged.

It Has Been An Extraordinarily Warm Winter

P.S. Back to social for just for a second. A few years ago, someone told me that hell would freeze over before American Funds had anything to do with social media. Well…with no fanfare American Funds last week established a Facebook page. Just sayin’.