The Gladys Kravitz Guide To Snooping On Your Neighbors

/ Tweet

Gladys Kravitz, the Bewitched character who felt it was her duty to keep tabs on her neighbors—I’m hoping you’re familiar with this 1960s sitcom via Nick At Nite or maybe the half-hearted movie—was simply ahead of her time. Today, she might be Director of Competitive Intelligence and Strategic Benchmarking Insights for an asset management firm.

Something was going on over there, Gladys was right, and she was relying on only her keen powers of observation.

If you are equally as passionate about your neighbors/competitors online, today you have many more tools at your disposal. I’ve written previously about SharedCount, SimilarWeb, App Annie and SpyFu, among others. Here’s a quick look at four more that you can use to snoop with.

How Do They Do That?

If you’re wondering how a competitor is working its own brand magic, just use BuiltWith.com to check under the lid.

Information on the enabling technologies running a Website can be valuable to technology solutions salespeople (BuildWith’s target audience) and the pricing packages reflect the value and power available, including SalesForce and LinkedIn integrations.

My needs (e.g., which firms are using WordPress as their blogging platforms?) are simple, and yours may be too. For us, the Chrome extension provides more than enough intelligence on the content management, Web analytics and marketing automation solutions powering mutual fund and exchange-traded (ETF) fund sites.

For example, here’s an excerpt of the American Funds technology profile, showing the analytics and tracking technologies employed.

Banner Bonanza

Are you in need of inspiration for an upcoming digital campaign? Well, you could make a nuisance of yourself on the trade media sites, reloading and reloading hoping to catch different creative. Or you could head on over to Moat.com, where you can search by advertiser and find multiple ad units. Clicking on one of the ads will reveal some information about where it last ran.

Media planners would do much more with this site, and brand analytics are what Moat sells. Here again, I'm appreciating what Moat gives away.

The screenshot below shows the detail provided on one of 765 Vanguard ads Moat has logged.

Watch This

YouTube success requires standing out from the crowd, because the crowd is adding 100 hours of video each minute of every day.

If you’re not familiar with optimizing for YouTube or if you’re unhappy with your results, VidIQ Vision is a terrific tool that enables you to learn from how others do it. Just add this Chrome extension to your browser and you’ll see detailed publishing information about every video you review on YouTube.

While you could limit your research to just mutual fund and ETF firms, why not learn from what the top brands on YouTube are doing? The screenshot below shows the optimization supporting a GoPro video published a week ago, which now has almost 2 million views. Note that strong social support and a large follower base helped drive views, too.

What’s Working?

As I blogged about last week, content marketers need to focus on what’s working and produce more of that while producing less of what isn’t working. Simple.

Your analytics on your content are central to that analysis, of course. But—since your competitors are also writing for the same audiences—there’s something to be learned from the content that’s taking off on others’ sites.

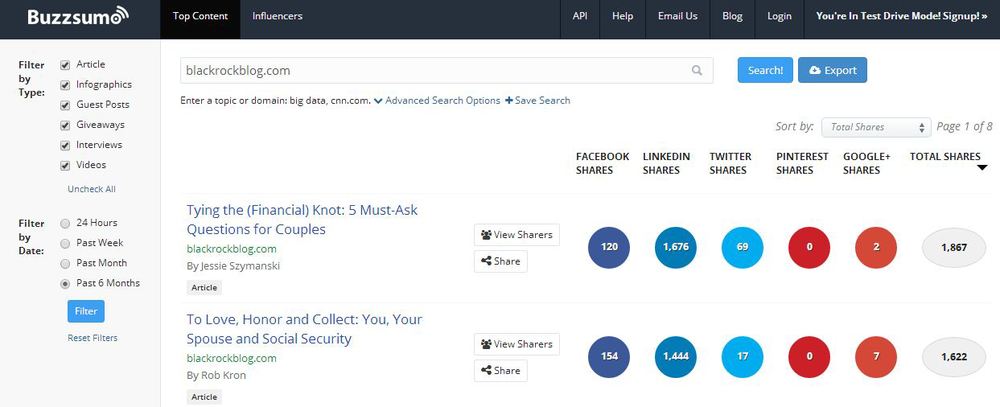

Use Buzzsumo for this.

Let’s look at the BlackRock blog, which is not just the most prolific but probably the most socially shared. Check out the Total Shares column at the far right. Quality, frequency and social appeal can be a powerful combination.

You could spend hours on this site. Note the advanced filtering and exporting capability. It produces results for Web pages as well as for blog posts. Buzzsumo sells solutions for influencer analysis but you can see a lot with a trial account.

Now let’s go out there and make Gladys proud.