Some journalists today are compensated in part based on Website clicks, pageviews, unique visitors, social shares, comments and/or the amount of time readers spend with the content they create.

That wouldn’t work for asset management content marketers, I’m pretty sure. But the more I learn about how publications evaluate the effectiveness of discrete pieces written by the journalists, I think there’s something to take away from the measurement rigor and accountability the approach implies.

I have to laugh every time I hear a marketer say, “It was a great _______[campaign, whitepaper, blog post]. Everyone thought so. But it didn’t work so well.”

If it didn’t produce a response, then it wasn’t so great. Agree?

Response must be the measure against which content is evaluated. Content that produces a response has to be assumed to be more successful than content that doesn’t.

And yet in the absence of a thoroughly considered framework for tracking what’s working and how, we get these cray cray conclusions that lead to more "great, but zero response" content.

Below are some thoughts, as I bounce between what’s different and what’s similar in journalists’ and marketers’ content creation and analysis.

Content Creation Can Be Hard Enough

Pay-per-click journalism is controversial and not commonplace. As a 21-year-old J-school grad, I would have opposed it. I would have said that journalists should be covering the news and what’s important. Thankfully, many still do.

While I have plenty of reservations about paying per click, the approach compensates journalists (and other writers) for identifying what people most care about, as suggested by the attention and engagement their content drives.

One of its most outspoken defenders is Gawker founder Nick Denton. Gawker is not a site that one would ordinarily benchmark a mutual fund or exchange-traded fund (ETF) site against. The photo on its home page today helps make this point. :)

Denton reportedly displays analytics on the wall of the Gawker newsroom showing data for the whole Gawker network and individual writers.

“We find that numbers keep a writer conscious of an audience; and managers alert to the motivation of the writer,” HubSpot quotes Denton as saying.

While pay-per-click writers are motivated to find subjects or approaches that stimulate response, that’s not where marketers start. Marketers need to work with whatever their firms have to offer, and the business' priorities, and then try to figure out how to communicate in a way that people will respond.

Another difference: The work of most journalists benefits from the trust and authority earned by their publications over the years. Content marketers need to build both trust and attention. With Compliance riding shotgun, asset management marketers in particular need to be relevant, avoid any hint of the self-promotion that will repel followers all the while incrementally growing their brand.

Content marketing is an art, and when the art has been created there’s the tendency to sit back and admire. OK, take five. But not six.

Too much talent, time and money is being invested in the creation and distribution of mutual fund and ETF content for us not to improve on our measurement of its effectiveness.

Insisting On An Identifiable Quality Standard

On the Web, there’s no limit to the number of pieces that a publication can publish. Journalists can have at it.

This is not true for marketing communications, even those positioned as content pieces that discuss topics at levels above the products and services offered by the brand.

Your audiences—whether you reach them using your own means or whether you access them via a partner—have a limited capacity for what it wants to hear from you in a given period of time.

Too much too often runs the risk of alienating, unfollowing or your communications being tuned out on.

Marketers have effectively stated the case for limiting the number of emails sent from their own domains. Now there’s also a reason to serve as gatekeeper on all communications including blog posts and social updates.

To preserve the prospect of your next high-quality communication commanding the attention it deserves, you need to impose a content quality standard. This is a new expectation and will require Marketing to assert itself in a different way. It involves added accountability for the content originated by Marketing but also for those elsewhere in the firm who contribute content.

In its traditional role, Marketing can be counted on to make sure that the content is going to look good. And, it’s going to have been proofread. Marketing typically oversees the content distribution.

The job of measuring and communicating the effectiveness of the content is the new job that falls to Marketing.

A Portfolio Approach

Journalists submit pieces to be published on Websites or apps maintained by publications with established brands.

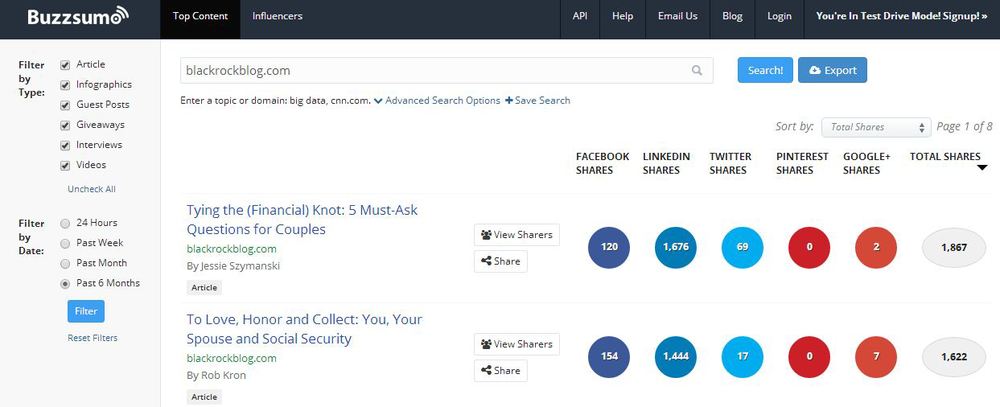

Those who manage the metrics for journalists know exactly which topics produce the greatest response, and by referral source. They maintain rankings of writers, organized by any number of available variables: clicks, shares, pageviews, unique visitors, repeat visitors, etc. It’s the publishers' business, their focus must be on the performance of the content.

Marketing’s digital content creation is much different. Its scope is broader (Your domain? Your lists? Others’ domains? Others’ lists?). There’s a wider range of content formats to consider (Text? Images? Presentations? Video? Apps?). Content creators may include staff, outsourced help, the firm’s investment strategists, product people, index providers, etc.

It’s your business, too, and it all adds up to the need to take a portfolio management approach to that content that's being created and distributed.

Content marketing’s aggregate return on investment will be the result of the strongest performing, average performing and underperforming pieces. What are yours? Who are your top contributors? What are your can’t-miss topics and which are the no-goes? What type of content is best at driving subscriptions? What do people most like to share? What converts best?

Data tabulation is an obvious important part of managing a content portfolio, but it can't stop there. If there’s a significant difference between the performance of your strongest and weakest performing content—on a multiple author blog, for example—I wouldn’t be so nonchalant. Use the data to step in and have whatever difficult conversation might be indicated.

To preserve and grow your audience, to optimize all organic and paid communications and to manage relationships with its content providers, Marketing needs a view of the content portfolio at least as comprehensive as what publishers maintain.

Response From Whom?

A click is a click to most publications. Gawker is the exception in that it's attempting to assign values to its readers based on their propensity to share. By and large, most publishers' compensation schemes don't distinguish between whether the traffic generated by a content piece is the "right" kind of traffic.

What’s different for Marketing is that you do care what’s working with what types of audiences.

It matters whether your LinkedIn likes and shares are coming from financial advisors or from job-seekers and vendors, for example.

Response by audience is a dimension to be documented, and learned from.

Paying For Performance

Unlike most pieces written by journalists, content that’s created by mutual fund and ETF firms is an ensemble effort. It wouldn’t be fair to either incent or ding an individual based on response measures.

Still, wouldn't it help to have a view into which staffers are writing the top-performing email subject lines? Who’s writing the headlines that are producing the most search traffic?

Such data may not (or may) ever make it into the performance evaluations of an individual or team. But understanding individuals’ strengths and weaknesses is also part of optimizing a content effort.

What are your thoughts? Your insights are welcome below.