Some Level-Setting About The Sharing Of Mutual Fund And ETF Content

/ TweetInvestment firm marketers need to take what’s known and reported about the social networks overall and then do their own thinking about the opportunities for the business they’re in and for their firms.

That second step is important, given the hoopla surrounding social media activity and results. Some of what builds expectations about the benefits of social media doesn’t apply to the largely business-to-business wholesale distribution context that most mutual fund and exchange-traded fund (ETF) firms operate in.

Interest in social interaction is keen for several reasons. There’s the opportunity to build awareness by being social and there’s the potential to demonstrate relevance as a member of an online community. Near the top of the list of reasons, in part because it’s eminently measureable, is the promise that social networks will help spread asset manager-authored content. It’s a wish, a hope and a prayer of firms that have social accounts and also those that don’t.

How much sharing of homegrown investment company content is there, really?

Based On A Sampling Of September Posts

You and your firm have access to the best, most complete data on usage of your own content, including Web analytics. But to get a sense of what’s happening across the board, I’ve reviewed some sharing data across a sampling of continuously content-producing asset manager sites.

My objective wasn’t to identify what firm's content is being shared the most. Sharing is a function of the size of the audience initially reached, which in turn is a function of brand, promotion, firm size, energy the firm devotes to social networks, timing of the content posting, etcetera etcetera.

For this exercise, the focus was on the extent to which content published on mutual fund and ETF domains gets a lift from those who share links to their social networks. Based on the social sharing counters on some sites and on some other signs, I had a hunch.

Please note that what follows is a look at asset manager content sharing that’s limited in scope and time. The review was contained to investment commentary-type content published, mostly on blogs, by 10 firms. Included were all posts published by these firms in September, a total of 111 posts. The mix included 22 updates in the month from BlackRock on the high end and 4 from MFS on the low end. An additional 22 financial advisor-directed September posts also were reviewed, you'll read more below about those.

The sites whose content was included:

- Context, the AllianceBernstein Blog on Investing

- The BlackRock Blog

- The First Trust Economics Blog

- Beyond Bulls & Bears, Franklin Templeton

- Guggenheim Partners' Macro Views

- On the Lookout, MFS

- OppenheimerFunds' Blog

- PIMCO Insights

- Vanguard Blog

- The WisdomTree Blog

The tool I used was the SharedCount multi-URL dashboard, which I believe to be reliable based on checks against my own site and other sites’ analytics. A few counts disagree with the counts published in the social sharing icons on a few asset manager sites.

SharedCount reports on multiple sites, but sharing of investment company content appears to be contained to four sites: LinkedIn, Facebook, Twitter and Google+.

I looked at the September URLs from the sites and then exported and combined the sharing data as of October 15 to produce scatter charts. You could do the same with your competitive set.

A Few General Insights

This data suggests:

- If you're serious about supporting the sharing of your content, you might take a look at how you present your social sharing icons. Move them up top and make them so big that they're impossible to miss.

- Firms large and small are reporting more success with their content syndication efforts. Making content available on other, better trafficked sites with better reader engagement is a critical piece to making sure your content gets the attention it deserves.

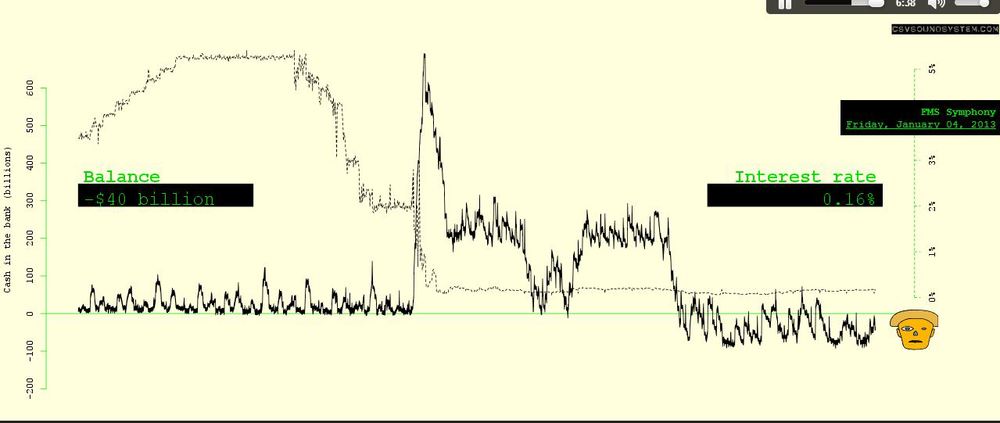

Public sharing from asset manager domains to social networks is at its highest on LinkedIn, based on how LinkedIn sharing (1,533 total shares) trounced all other sharing to other networks in September. Here's a look at the distribution of the LinkedIn sharing data from each September post.

Even so, few asset manager posts attracted more than 50 shares in September. See the Track Social site for an idea of how leading brands are doing. The top 10 brands on LinkedIn attracted more than 3,700 Likes last week—with LinkedIn itself topping the leaderboard with almost 15,000 Likes.

A total 722 Facebook Likes and Shares ranked Facebook second on the list of shared mutual fund and ETF domain content published in September. Facebook users' support of Franklin Templeton content had a lot to do with it.

For reference, according to Track Social, the top 10 brands got at least 45,000 Likes on their posts per day, as of data reported last week. Fox News tops the list with 117,000 Likes per day.

Most September asset manager posts prompted fewer than 20 tweets, for a total of 601 shares.

The Track Social data is not relevant here because the closest measure would be to look at brand retweets. However, not everything that a brand tweets is about content it’s posted on its domain. The top 10 brands got more than 4,000 retweets of their tweets per day last week, with ESPN getting more than 15,000 retweets. Yes, not much of a benchmark for this space.

A low level of content shares will limit a firm’s prospects for awareness-raising and relevance. But remember that this kind of content-sharing analysis goes only so far. The next step is to understand the amplification effect of the content shares.

Amplification is something that Twitter is particularly good at, and fortunately for us, several tools are available to analyze what’s happening for an account on Twitter, including its reach and even effectiveness.

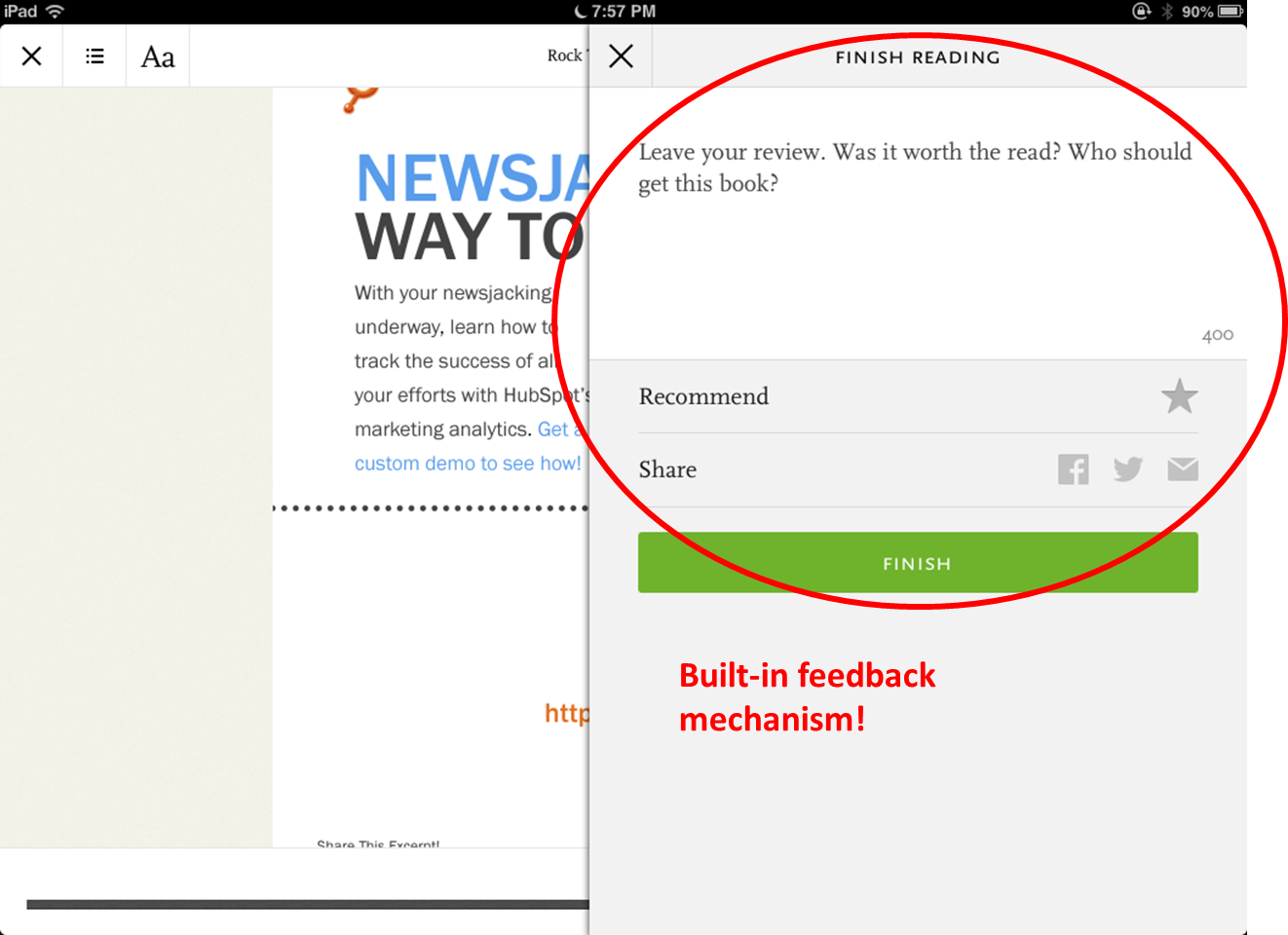

Below is a screenshot from Topsy showing the total number of tweets and the total number of “highly influential tweets” to a PIMCO post. Topsy tags the top 0.2% most influential of all Twitter users as “highly influential," and “influential” tags are used for the top 0.5% most influential Twitter users.

Fewer Twitter shares by influential accounts capable of amplification have the potential to get you just as much or more reach than LinkedIn shares by accounts with limited connections and reach. Unfortunately, in a spotcheck of Topsy of the September posts in our sample, very few were tweeted by highly influential accounts. And, that’s something to work on. I would do that before I gave up on Twitter.

Google+

Google+ brings up the rear, with asset manager September content appearing only rarely (20 shares in total) on public posts. It’s possible that more sharing is happening in private posts, not trackable by SharedCount.

Content shares on top-performing brand Google+ pages are much lower, too. The top 10 brands got about 117 shares, with YouTube topping the Track Social list with 313 shares, last week.

Financial Advisor Content Sharing

We’ve taken a look previously at where financial advisors are sharing content, thanks to the data that RegEd Arkovi regularly publishes. It’s a safe guess that those shares include asset manager-created content.

But, an analysis of the content published on blogs that are specifically published for advisors shows even lower level sharing. Included in the analysis were September posts from:

- Putnam Investments' Advisor Tech Tips blog

- Russell Investments' Helping Advisors blog

- SEI's Practically Speaking blog

- Vanguard Blog for Advisors

LinkedIn is again the network the advisor-directed content is most shared to, followed by Twitter.

Let's start with the fact that the universe of potential sharers is small. And, a fraction of the approximately 300,000 U.S. financial advisors have social accounts and are likely to be sharing content on any given day. Also, surfacing content that other advisors will find valuable is not an advisor’s first priority in establishing a social presence.

A cursory review of other advisor-directed Websites (media sites and prominent bloggers) suggests more sharing than asset managers are experiencing. Unknown, though, is how many of the sharers are advisors versus others in the financial advisor ecosystem. On those sites, sharing via Twitter rivals the level of LinkedIn sharing.

Thoughts? Your comments are welcome below.