Mobile Adoption In Financial Services: Lack Of Awareness, Skepticism, Impatience

/ TweetTypically, banks get all the attention in reports on mobile adoption in financial services. That’s as it should be, since mobile apps and banking transactions on the go are a perfect match. The investment management and insurance industries tend to bring up the rear. However, a Webinar this week presented research that included some interesting, segregated findings and consumer insights about each of the segments.

You can listen to “Deloitte’s Mobile Strategies in Financial Services: Barriers and Opportunities” in its entirety on demand, and download the slides. Also, there’s a related blog post by Jim Eckenrode, Executive Director, Deloitte Center for Financial Services, that provides this succinct summary of the findings: “Our research has found that mobile adoption across financial services has been a crazy quilt of equal parts unawareness, skepticism and impatience with financial services providers.”

You can listen to “Deloitte’s Mobile Strategies in Financial Services: Barriers and Opportunities” in its entirety on demand, and download the slides. Also, there’s a related blog post by Jim Eckenrode, Executive Director, Deloitte Center for Financial Services, that provides this succinct summary of the findings: “Our research has found that mobile adoption across financial services has been a crazy quilt of equal parts unawareness, skepticism and impatience with financial services providers.”

Below I’ve cherry-picked some of the more interesting statements about investment management and mobile. The findings are based on a survey that was conducted during the first two weeks of January and had a total sample of 2,193 respondents, about 22% of whom were from households with income above $100,000 per year. The sample was weighted to represent the broader U.S. smartphone population.

Calling The Call Center From A Smartphone

The consensus of the presenters and the Webinar attendees, as expressed in their response to a polling question, was that financial services has not leveraged the mobile device to any great extent.

While there’s a range of mobile services that banks can support, and insurance companies can offer account servicing and claim filing and tracking, the specifics in the presentation on what investment management firms offer via mobile was a bit light.

In fact, most non-brokerage investment apps today do little more than deliver content, replicating what can be found on the thought leadership sections of Websites, and product data, most of which can be found on any number of finance sites.

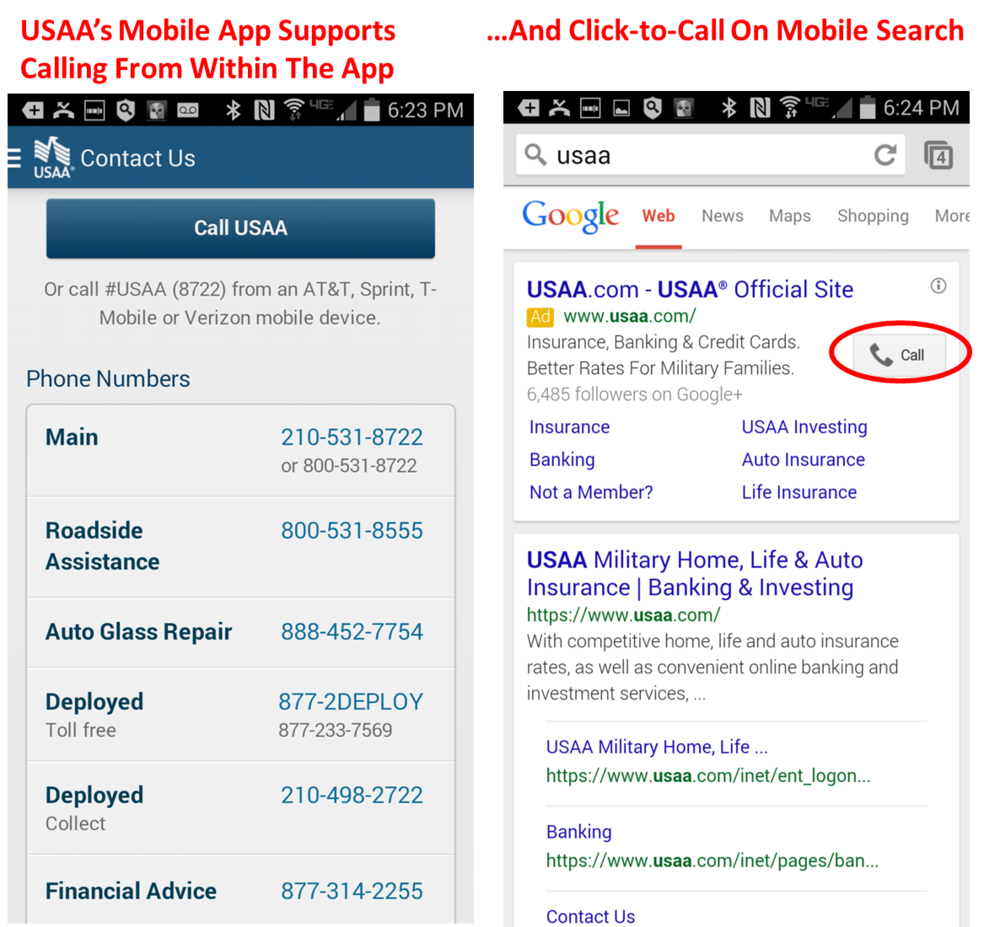

A throwaway comment—that 58% of call center interactions came from a smartphone—piqued my interest. Those of you who have this data from your own mutual fund or exchange-traded fund (ETF) operation may be well ahead of me.

Is device-appropriate client service where investment management mobile development could more meaningfully focus? Not to the exclusion of making content available but in addition to?

Any financial advisor or shareholder calling Client Services for help today on a smartphone as opposed to while in front of a desktop is likely having a subpar experience.

And yet Deloitte says mobile technology (including smartphones but also wearable technology and the Internet of things) has the potential to dramatically reshape customer engagement. It's possible to deliver a better experience to mobile users, taking advantage of the unique attributes of the channel.

As Eckenrode comments in his post, new technologies “are being added to the mobile platform that take advantage of its ability to know where it is, see what is around it, communicate with other local devices and connect with information sources that have yet to be deployed.”

Today smartphones have onboard sensors that include accelerometers, compasses, cameras, microphones, pedometers, GPS, proximity and ambient light detectors, and gyroscopes. Future developments will likely include the ability to detect temperature, pressure, eye movement and gestures, location and magnetic fields, Eckenrode predicts.

Location-aware, Context-Specific

The Webinar discussion expanded on the importance of location-aware and context-specific experiences for mobile users.

I took a quick spin around some of investment firm mobile apps and note that just a few apps today (the screenshots show USAA, an exception) offer click-to-call capabilities. Actually, some Websites still lack clickable phone numbers for mobile visitors to use.

It’s apparent that we in this industry have a distance to travel to be in a position to offer smartphone-using advisors or others the video call support or mobile ad-hoc networks mentioned in the Webinar, for example. If you’re not making big plans already, this discussion will broaden your perspective on the mobile app and “mobility” in general.

The Status Quo

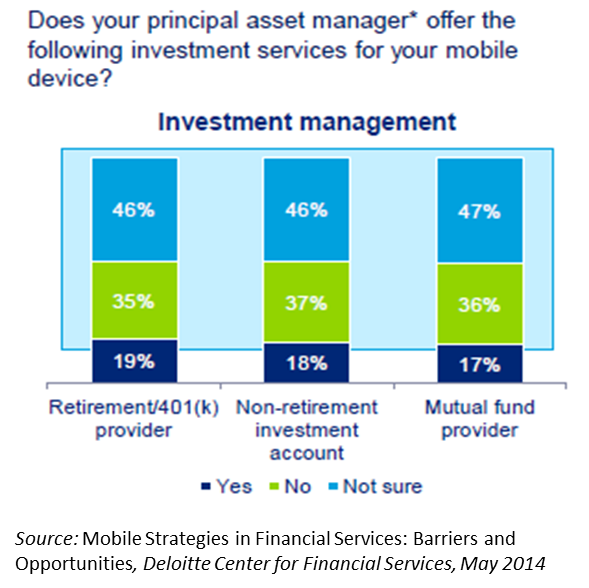

The Deloitte data provides a look at where we are today: Almost half of the survey respondents aren’t even sure whether their principal asset manager offers a mobile app.

In October 2013, the last time I took a comprehensive look at asset manager apps, I thought I detected a certain malaise regarding apps and app updates. Awareness, the presenters noted, is a prerequisite to adoption, user experience and ultimately engagement. We might tack on availability to the front of that list.

Also noteworthy from the research:

- Only 23% of respondents said the ability to deal with their investment firm on a mobile device was extremely or very important. An advisor-only survey to advisors would produce different results. And, still, respondents would be reacting to just what they think might be delivered via mobile. Marketers could imagine and ultimately deliver more.

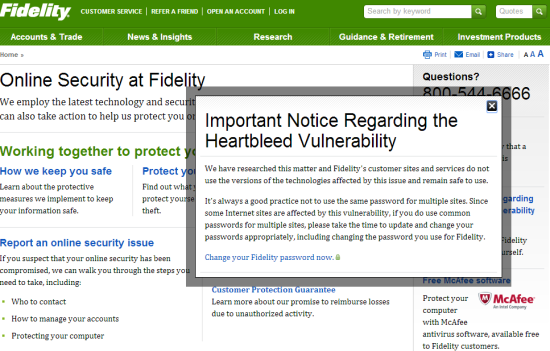

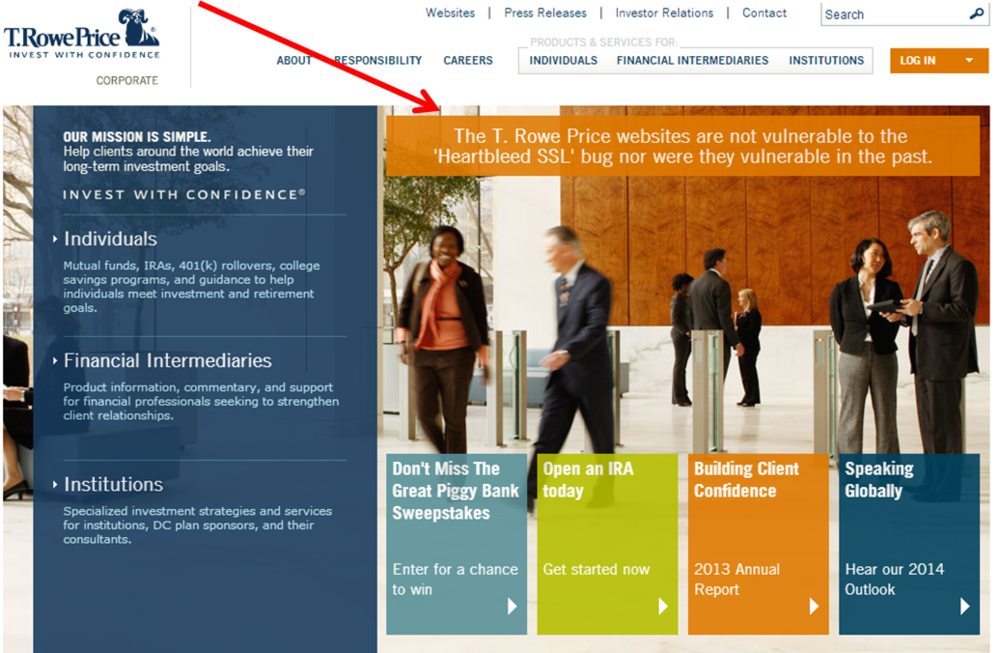

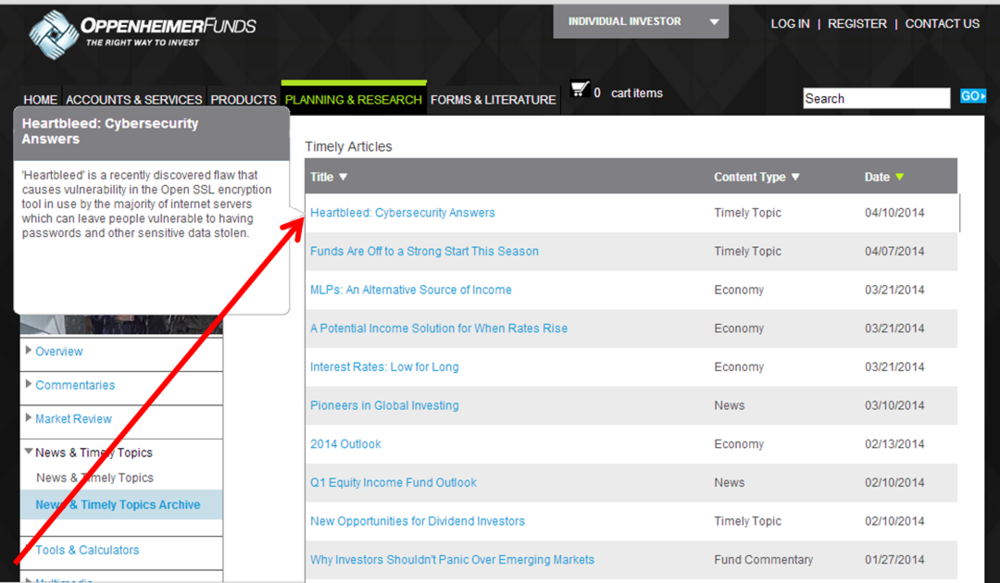

- More than half (54%) of investment management clients have concerns about data security over mobile devices. That’s less than bank clients (64%) but more than insurance clients (45%).

- Survey respondents and the Webinar attendees agree that the creation of a more secure wifi or mobile network was the most appealing way to provide customers security reassurances. Eight out of 10 respondents also thought that a system that would automatically disable a stolen device would be reassuring as well.