Do Google+ And Fund Companies Have A Future Together?

/ TweetHow much longer can asset managers keep their distance from Google+?

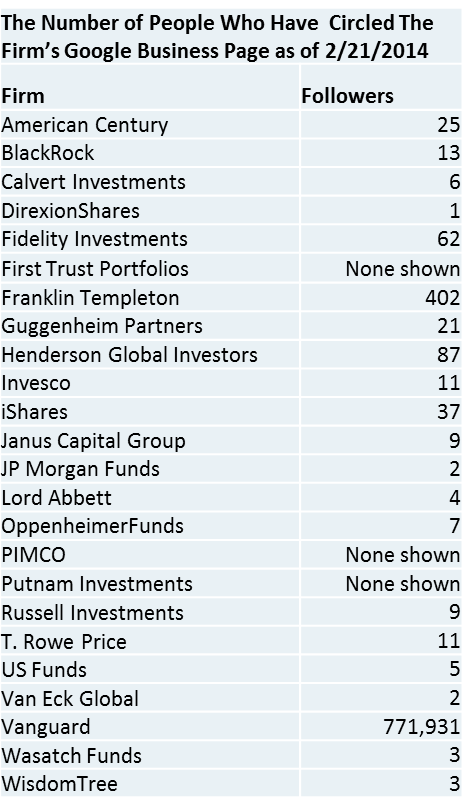

The table at right demonstrates the shallowness of fund company engagement on Google+ across the board. Of course, these companies have few followers—there’s almost nothing to follow! Vanguard stands out as an exception but more on that later.

Many fund companies have Google+ pages only because a Google+ account is required to establish a YouTube channel. Fourteen of the 24 names on the list have never posted an update.

From most of the other firms, there are relatively few public posts, almost zero sharing and, as you can see, followers in the low double digits. Engagement data for all the accounts can be found on AllMyPlus.com. It’s mostly goose eggs.

Fidelity Investments, the Mikey of the investment industry (Fidelity will usually try anything), has a page but it doesn’t have any branding, let alone any activity. I, and its 61 other followers, think this is its official page. Two titans on other networks, PIMCO and iShares, are distant also-rans on Google+.

Why is there such indifference to Google+? I can think of a few reasons. If you have other ideas, please add them in the comments below.

Not enough people, not worth the time

Since its launch in June 2011, Google+ has had its doubters. Critics continue to contend that the site is no more than a ghost town where accounts are created and then abandoned.

Google is steadily fighting back on two fronts. For one, it’s increasingly integrating Google properties. In addition to yoking YouTube channel creation to Google+, Google now requires commenters on YouTube to have Google+ accounts.

Google is also steadily enhancing the network’s features (e.g., post embedding, image handling and Google Hangouts—which I've loved for this business from Day 1), all of which help drive usage. In October 2013, Google reported that 540 million people were active across Google each month, and that 300 million people were active in the Google+ stream.

With its growth trajectory, sharing on Google+ is on track to overtake Facebook sharing in two years, according to Searchmetrics projections.

Not enough relevant discussion

When you consider the composition of Google+ users, it could be tempting to conclude that investment topics would be out of place. According to a third quarter 2013 study by Global WebIndex, almost one-third of users are IT workers (and lots of them employed by Google, it’s believed). Since Day 1, it was reported that techies had found a new haunt.

And, not shown here but reported elsewhere, photographers and others in the visual arts gravitate to Google+ because of the gorgeous way it displays images.

Look at the chart of the bottom 10 types of people who use Google+ and you’ll see two groups that make up a significant percentage of investment firm clients—those in the 45-54 and 55-64 age groups.

Even top financial services accounts on other networks have relatively poor showings on Google+. One of the leading financial services Twitter accounts, Bank of America, has fewer than 23,000 followers on Google+.

Except…then there’s Vanguard. Vanguard’s Google+ page has attracted 770,000-some followers and 928,000 who have +1ed the page. Vanguard has six times the number of followers it has on Twitter.

Props to Vanguard for doing its typical outstanding job in consistently publishing engaging content, appropriate to the network. According to AllMyPlus.com, Vanguard’s single most popular posts have attracted 49 +1s, 18 comments and nine reshares.

Admittedly, this is nowhere near the same kinds of engagement numbers that some consumer brands rack up. For now, Google+ isn't where the home runs are being hit, just singles and doubles.

Vanguard’s success is unique, even among the largest brokerage accounts Charles Schwab (1,200 Google+ followers) and TD Ameritrade (963 Google+ followers).

But, presumably, Vanguard’s followers are people who are interested in investment-type content and could conceivably follow other investment-related accounts.

And get this: While Barron’s has no more than 100 Google+ followers and Yahoo! Finance fewer than 8,000 followers (maybe they’re not trying too hard on Google’s property), the Wall Street Journal has been circled by more than 3 million accounts. (Note the presence of senior decision makers in the top 10 users table above.)

With more than 6 million followers, The Economist account is #10 on the Google+ most followed accounts leaderboard, according to GPlus.com. The numbers lag what's reported on the Google+page but this line chart is a compelling argument against the ghost town claims.

Here’s one of The Economist's recent popular G+ posts. How is this content different from what your firm might share? Note that it attracted 644 +1s and 323 shares.

Not available to regulated firms

With LinkedIn, Twitter and Facebook access, technology enablement was the first hurdle for most asset managers contemplating a presence on a site that wasn’t their own. Firms couldn’t make any plans unless they were certain they’d have a reliable way of archiving what they posted.

I doubt this has been the primary inhibitor to Google+ participation. But the ability to archive Google+ content has been slow in coming, confirms my buddy Blane Warrene, founder of Arkovi and most recently of RegEd.

“The Google API is improving on the Plus front. Google initially released access to the individual profiles, and in mid-2013 to the Business pages. That makes a big difference as a firm can get the data to archive. Many of the known social archivers are adopting the G+ API as it sees momentum,” Blane says.

Although publishing to Google+ from a third-party app is still limited, the posts, interactive data (links, photos, videos et al) and engagement data all are now available, he says.

Nobody we know is there

Participation on Google+ offers significant, not-available-anywhere-else SEO benefits that alone could be justification for posting to it. But, as a social network, it also offers the lift that come when others support posts by +1s and sharing.

Even if hundreds of millions of users are on Google+, it can still be a lonely place when you post and all you hear is crickets.

I continue to be intrigued with a finding in a 2013 Putnam report on social media and advisors. Almost one-third of advisors surveyed (31%) said they used Google+ in the past year for business purposes. It was second only to LinkedIn, as I noted in a post last year.

Financial advisors today have more of a business imperative to commit to Google+. Their brands need to be discoverable in local Google searches, and Google’s integration of Google+ accounts and whatever online content the advisors author play a key role in search engine rankings.

With archiving capabilities in place for them, expect more advisors to sign up for Google+ and spend some time there, whether browsing or posting content or taking part in communities and Hangouts.

As one measure of advisor activity, I checked two Google+ accounts that might be assumed to have strong advisor interest—+Michael Kitces, a financial planning thought leader, and +Bill Winterberg, a leading commentator on technology for advisors. Both accounts get a healthy level of engagement.

In short, there are signs of relevant life on Google+.

Should you/can you commit?

In the last year, it’s become urban legend that financial services is the second most discussed topic on Twitter, after entertainment but before sports. Most recently, this was quoted to me from someone who heard it from his Twitter sales rep. I'd still like to see some data on that, but I do believe that if you’re an investment firm, you belong on Twitter, no question.

The Google+ decision to fully participate is not so cut-and-dried. You’d have to be convinced that there’s a community there that’s sufficiently vital to follow your account and then be continually active on Google+ to see and interact with your content.

And if you’re hoping for anywhere near Vanguard-type results, you’ll have to be all-in. That includes “listening” to what’s being said and exploring what's unique to Google+. Sharing others’ content—something practically no investment-related firm does today on Google+—may be needed, too.

May I be direct? In the two-plus years since Google+ launched, we just haven’t seen the kinds of efforts from this industry that other industries have made or that firms in this space have made on Twitter, LinkedIn and Facebook.

Some firms have yet to even populate the About tabs of their Google business pages. Few of the firms that are posting are doing anything more than posting their YouTube videos or blog posts. Almost none have added the badges to their Websites or include the link to their business pages in their signatures, along with their other social identities.

Hanging back was a relatively no-risk strategy that worked on Google+ in its early days when probably no one was paying attention to you or your sketchy page. It may be time to revisit the decision. Google+ offers an increasingly attractive opportunity to raise awareness and broaden the reach for investment firms willing to work for it.

It’s your prerogative to take a pass on Google+. Just make sure that you have an updated understanding of what you may be forgoing.