Ripped From The Headlines: 3 Notes For Your Mobile Strategy

/ TweetThe news this week produced three random reports that might help ground your mobile planning in reality.

Stand-out iPad Apps For Advisors

From Investment News, here's a video preview of some stand-out iPad apps that will be cited in the publication's upcoming vendor and technology usage report.

If your app plans call for you to port the text content that nobody reads on your advisor Website to this new medium where nobody will read it, don't take your mobile victory lap just yet. This report by technology reporter Davis Janowski highlights where the bar is moving.

Franklin Templeton's app is the only asset manager app mentioned (see the 2:50 mark), and rightly so, for the ability to print and/or email fact sheets from the app.

More to come in the August 27 release of the Investment News' Tech Trends special report, which promises to release additional insights on apps that advisors are using.

Downloading ≠ Usage

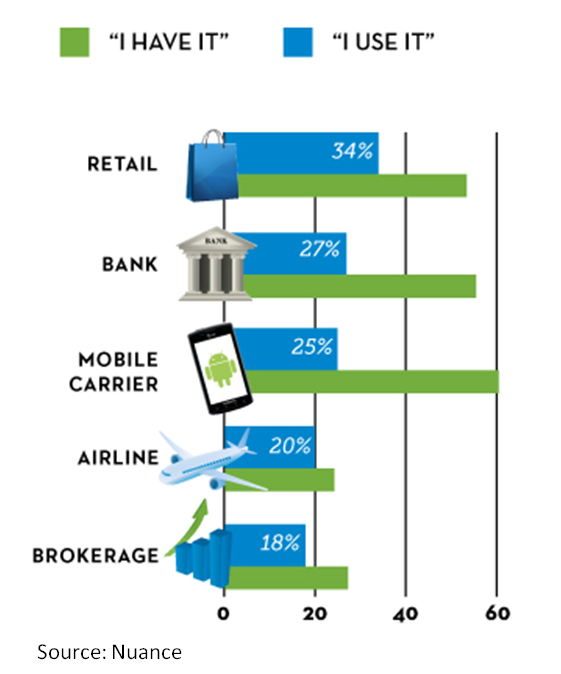

Data on consumer mobile app usage provides some perspective on the challenge facing app publishers, investment companies included.

Job #1 is to motivate a consumer to download the app. Seventy percent of consumers have 10-plus apps, according to this graphic slice from a larger infographic from Nuance.

Think of the rich variety of apps available. It's an impressive accomplishment for a mutual fund or exchange-traded fund (ETF) company to work its way into a consumer's set of 10. I like our chances more among users who download more apps, although reach contracts significantly.

Will downloaders use the app after they've downloaded it? That's the ultimate goal, but this data must give planners pause. At the top of the list, enjoying the most usage, are retail apps—and only one-third of users continue to use them. Apps from the brokerage firms—closest to investment company apps but offering much more functionality—are at the bottom of the list, with only 18% users.

My sense is that advisors download more apps than the average consumer but, like consumers, use a relative handful. We should learn more from the Investment News data.

What is it about your app that fosters investor or advisor reliance, driving repeat usage?

Voice: An Inevitable Requirement

Since the iPhone 4S launched with Siri, the voice-activated "intelligent personal assistant," it was apparent that voice could be used for more than just fun stuff.

Note yesterday's announcement that USAA will be piloting a Siri-like virtual tool for its mobile financial apps. The capability being tested happens to be from Nuance (which happens to be the source of the app data quoted above—sorry, I have no relationship and this is just a coincidence).

Who knows whether consumers will ever walk the streets openly asking their phone about the details of their financial transactions. But, are mobile advisors likely to gravitate to voice functionality, include product data searches? My hunch is yes, and that voice will soon become a requirement of competitive financial mobile apps.