RIAs, Content Scoring, YouTube Views: It’s A Random Reading Round-up

/ TweetI never met a free ebook that I didn’t download. I’m inclined to take online surveys and accept flyers from people on the street, too. Hey, we’re all in marketing, we have to support one another.

Here’s my latest report on a random collection of ebooks, reports, a presentation deck and a whitepaper that I’ve read in the last few months, and recommend to you.

Rounding Up The RIAs

“The RIA Channel: A Roadmap for Driving Growth” is a 14-page whitepaper from Broadridge. It’s a data-packed overview of how mutual fund and exchange-traded fund (ETF) marketing has needed to dramatically change as RIAs have become an increasing focus.

“While the four main wirehouses offer central points of contact and provide a degree of product and process uniformity for their approximately 57,000 advisers, a number of RIAs just shy of that number are spread among 14,000 RIA firms,” is how the paper succinctly summarizes the challenge (while simultaneously making the argument for digital).

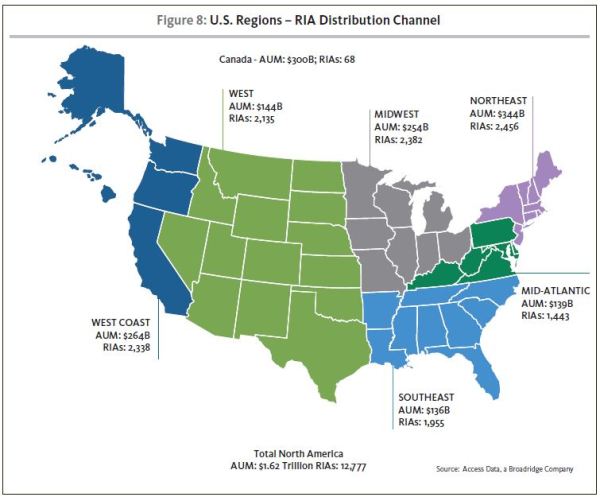

The paper includes insights on RIA segments and some suggestions for targeting the best prospects and product positioning. My favorite graphic maps where RIAs are in the country, shown below. Sourced by Access Data, a Broadridge company, it’s a nice content marketing turn, too.

A Broad Dive Into All Things Digital

Before you reflexively go to print Experian’s The 2014 Digital Marketer, you should know that it’s 138 pages long. Then again, it's a resource you may find yourself referring to all year.

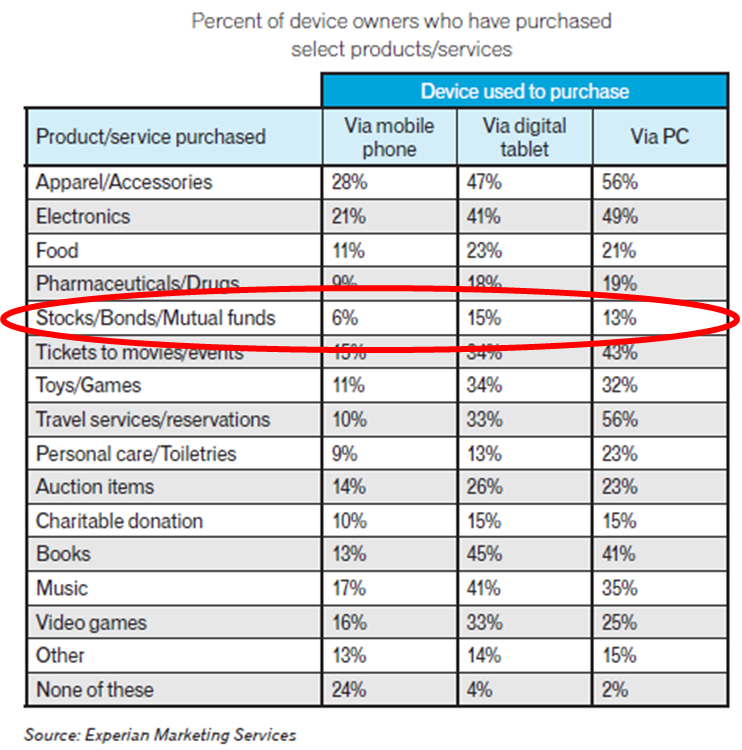

Published in March, this is Experian’s sixth annual report of benchmarks and trends. Financial services is mentioned as one of the leaders in Internet advertising, second only to retail, and there’s this table showing the percentage of people who transact stocks/bonds/mutual funds on mobile, tablets and desktops (more on tablets than on the PC?!).

But read this more as a lay of the land of all things email, mobile, social and search/display. Also, this year’s report devotes several pages to cross-channel marketing, as important to this space as it is to business-to-consumer businesses.

But read this more as a lay of the land of all things email, mobile, social and search/display. Also, this year’s report devotes several pages to cross-channel marketing, as important to this space as it is to business-to-consumer businesses.

Some Of These Are Not Like The Others

First there was lead scoring—online it involves interpreting a Website visitors' digital body language and behavior and understanding where they are in their information-gathering process. Because it’s marketers who are accountable for creating the online content offered at various points in the purchase funnel, it naturally follows that there should be some scoring of content, too.

This Kapost deck (the link opens a PDF)—and the video below—is slightly more commercial than the others in this round-up. Kapost sells content marketing software. Even so, it’s a good primer if you haven’t yet started distinguishing between the performance of your individual content assets. It’s a quick, heavily illustrated 40 pages. For the video, you’ll need to know that MQL stands for marketing qualified lead.

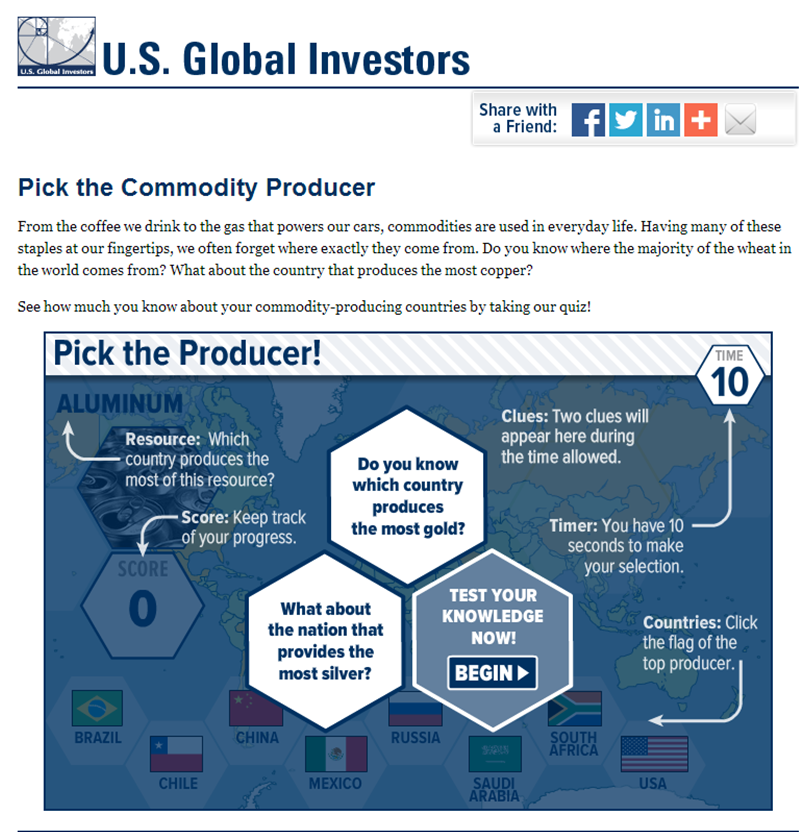

YouTube Views Before Subscribers

To no one’s surprise, OpenSlate’s Top 500 Brands on YouTube industry report does not include an investment company.

The most successful non-entertainment brands average 1.4 million average monthly video views and have an average of 82,000 subscribers. Investment firms don’t come close. In fact, the Business and Finance Industry, lumped together in a way that echoes YouTube’s maddening categorization, represents only about 20 of the top 500. And, they’re companies like SpaceX, Boeing, Geico, GE and Lockheed Martin.

Here’s the graph from the report that’s worth your consideration: The relationship between views and subscribers. On average across all YouTube channels, every 200 views results in a new subscriber, OpenSlate reports. Brands generally need almost four times that—750 views—to convert a single subscriber. And, as you can see in the OpenSlate graph below, “business and finance” channels need close to 1,000.

“There are many factors working against brands in this regard, including an inconsistent content and publishing strategy and the likely impression by a viewer that whatever drew them to the brand’s content in the first place will not be repeated. A high percentage of TrueView driven (paid) views by brands also has a large impact,” according to the report.

The Raw Power Of Tech-Driven Marketing

I don’t even know where to start to summarize this must-read perspective on how Marketing has changed. In the 40-page New Brand of Marketing ebook, Scott Brinker of ChiefMartec.com takes a leisurely approach as he recounts seven “meta-trends” that have led to nothing short of "cataclysmic" disruption in how marketers work:

- From traditional to digital

- From media silos to converged media

- From outbound to inbound

- From communications to experiences

- From art and copy to code and data

- From rigid plans to agile iterations

- From agencies to in-house marketing

You’ll see much of the research and many of the datapoints that digital marketers like to quote and cite (e.g., on average 57% of the buyer’s journey happens online before prospects even talk to a salesperson), but Brinker provides the context and direction for them.

The narrative builds as a call to action for marketing to step up and “harness the raw power” of what's disrupted it. Brinker—whose work I’ve mentioned before—believes that marketing needs to assume responsibility for technology strategy and marketing. Specifically, he advocates for the role of a chief marketing technologist.

“If you’re responsible for the outcomes—how customers will perceive your brand in the digital world that is run by software—then you cannot afford to take a laissez-faire approach to the technological mechanisms by which those outcomes are achieved,” he writes.

Even if you’re familiar with Brinker’s chief marketing technologist argument, read this book for the extended reasoning supporting it. It’s all there.

Read anything good lately? Your recommendations are welcome below.