Behind The Scenes Of BlackRock's New Advisor Insight Center

/ TweetIt’s been a while since a mutual fund or exchange-traded fund (ETF) company hosted something new and different.

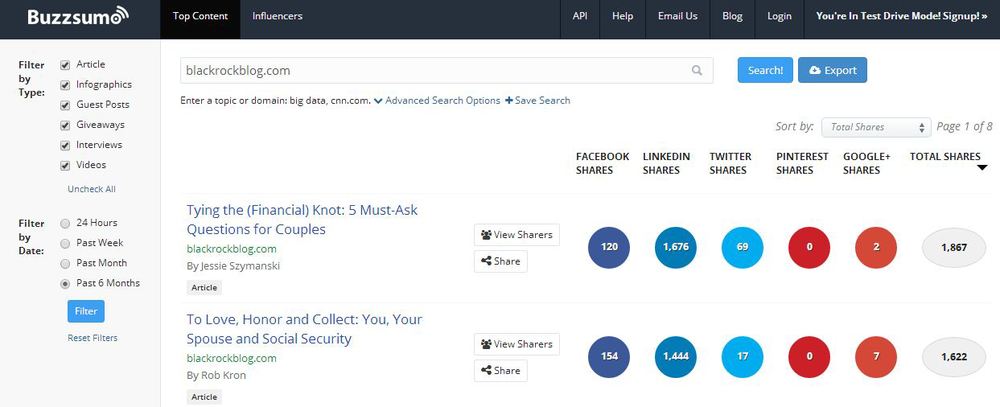

The trend of the last several years has been to package up content contributions and ship them over piecemeal to digital get-togethers on other sites with more—and more consistent—traffic from financial advisors. Asset managers pay to sponsor Webinars on trade publications’ sites, host LinkedIn discussion groups and use Twitter to share pithy insights and content links.

Taken together, these tactics can be an effective if disjointed means of regularly calling attention to thought leadership. The hope is that at least a few advisors will follow the content trail back to the mutual fund and ETF provider sites, where there will be a continued opportunity to educate about products and capabilities.

Launched five weeks ago, the BlackRock Insight Center appears to be bucking the trend, and a conversation with Rob Nestor, Managing Director and Head of iShares Product Strategy, is a reminder of the benefits of bringing people together on a site you control. BlackRock has built a thought leadership hub where they can control the registrations, keep the focus (it’s all BlackRock/iShares all the time) and gain insights to what’s resonating.

As you can see in the screenshot above, the imagery used on the site suggests that a virtual event is in progress, and note that the first content area is called Featured Sessions. In fact, the insight center is the evolution of a one-day virtual conference BlackRock sponsored for the last two years.

While BlackRock’s advisor site (Advisor Center) contains product information and tools, the center’s focus is on thought leadership, Nestor said.

“Our views on retirement, regulation, the move to fee-based advisory are frequently sought. While advisors told us that they appreciate the virtual conferences and Webinars we offer, they said they want to consume our content on their own time…This is a platform we can use to communicate interactively and personally, at scale,” Nestor explained.

BlackRock’s interest in "getting out there with a clear view about how to use active and passive investing in portfolios" was also a primary driver.

To date, 2,000 advisors have registered, according to Nestor. Of those, 80% have returned for at least one session. Advisors are spending an average of 30 minutes on the site, with 60% of the traffic occurring during the business day (10 a.m. EST and 3 p.m. EST).

While there were no formal projections of usage in the center’s first month, suffice it to say that BlackRock is pleased.

According to Nestor, advisors are remaining engaged with 15-minute and longer videos. Most popular has been the nearly 20-minute video, “The Price of Advice: Where The Industry Is Headed,” watched by one-third of the center’s visitors.

The center supports repeat visits by offering a Briefcase function for the saving of content and a My Personal Map to keep track of visited locations.

Building An Advisor Community

What’s most unique to me is the center’s suggestion of—and enabling of—community. There’s no other firm-sponsored and firm-hosted site that I’m aware of that 1)enables a search of members 2)enables contact saving and message-sending and 3)enables networking in real-time.

“We wanted to create a community that’s not reliant upon BlackRock being at the center,” said Nestor, which sounded like a bit of an oxymoron on an all-BlackRock site. He went on to explain that BlackRock can’t see which advisors are talking to who or what’s being said. Only aggregate user data is being collected and analyzed.

Although the center has already seen some networking, Nestor soft-pedaled what he called the “modest” networking opportunities. To date, most of the registered advisors have chosen not to make their profiles public (and therefore accessible to others). Nestor said some advisors just want to protect their privacy. I wonder whether some firms' Compliance policies also might be inhibiting participation.

The growth of the community aspect of the site bears watching. What firm wouldn’t like its own forum where it could engage advisors with its own offerings and have exclusive access to what they have to say, for a competitive, including product, advantage? This has been the dream of sponsors of advisor-only sites since back in the day.

Also, if it catches on, this could raise advisors' expectations when they log in to other firms' sites.

Breakneck Launch

Planning for the Insight Center began in late April and the site launched in August.

Just four months for a site like this? That’s breakneck speed at any asset management firm—even at the industry’s largest, I would guess.

Content development is one thing to have to coordinate. In fact, videos with some of the firm’s heaviest hitters were created just for the center.

Technology-wise, what made the launch possible is that the center is hosted on the same platform the firm used for its virtual conferences.

There are both advantages and disadvantages to outsourcing the development of an ongoing Web asset to a provider using its own proprietary platform.

A key advantage, according to Nestor, was the superior quality of the video and the underlying technology.

But it’s not an integrated experience. The URL clearly goes to a non-BlackRock domain: https://engage.vevent.com/index.jsp?eid=3787&seid=15&code=ishml Content searches are limited to what’s on the Insight Center, not what’s available from all of BlackRock.com. Some of the terminology (referring to registered community members as “visitors,” for example) is more suited to events. The attendee guide goes to a 2012 generic document about virtual environments.

Accessing from Apple devices prompts the download of an app from a publisher called Virtual Environments (BlackRock isn’t mentioned anywhere on the download page), and the Android app itself is devoid of all of the BlackRock branding.

Some of this would be a showstopper at other firms, and certainly BlackRock is no slouch in the branding department.

Yet, sometimes in the tension between “do you want it fast or do you want it perfect?”, fast wins with digital communicating—and it ought to. The fine points that marketers sweat out just don’t matter to most users, certainly not at launch. BlackRock wanted a way this year to showcase what it has to say, and it prioritized fast.

Given that most of the visitors are arriving during the workday, three-quarters are visiting via desktop (the best user experience), with 18% via their smartphones and 9% via a tablet, according to data BlackRock provided.

“It was a debate internally,” Nestor confirmed. “Could we/should we build it just as fast? But we felt [the platform] was best of breed.” And, he added, BlackRock IT is “looking at replicating the center internally.”

Support for live events is one of the platform’s advantages. It’s possible that BlackRock will use the new center to deliver its 2015 outlook live later this year, for example.

“Live events will be more the exception than the rule,” Nestor said. “They can be a little risky, everything has to go right at the same time.”

Promotion of the Insight Center has been via mostly digital means. I first heard of it from the BlackRock Twitter account but it's been mentioned in the firm's email, Facebook and LinkedIn activities. Limited targeted advertising is planned.