BlackRock Explains Its Sponsored Update Success

/ TweetOne of the best things a company can do is show its customers how other customers are using its products. Have you ever seen the GoPro videos?

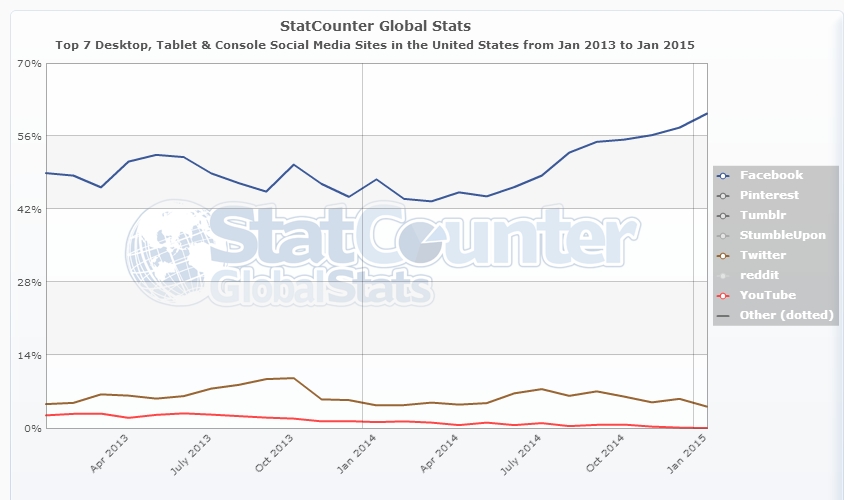

Even though Twitter, Facebook and YouTube aren’t business-to-business platforms, I wish they’d support the financial services user group, as LinkedIn does. Most social stuff does not come naturally to finserv marketers, and the world isn’t necessarily waiting for socially shared financial content. A little help can go a long way in maximizing what can be large budgets and promising careers.

While we wait for the others to step up with specialized training, LinkedIn continues on its merry way producing events (such as FinanceConnect happening this week in New York and today online), ebooks (see The Sophisticated Finance Marketer Vol. 2: Balancing Real-Time News with Planned Editorial Content) and Webinars.

The latest of the Webinars—How BlackRock Became A Sponsored Updates Superstar—was held yesterday afternoon. I've embedded the 57-minute presentation below.

This isn’t all benevolence on LinkedIn’s part, of course. In its earnings announcement last week, the firm reported that Sponsored Updates, its primary content marketing product, account for more than 40% of its overall Marketing Solutions revenue of $119 million.

That’s a big improvement for the quarter (although Marketing Solutions revenue overall was down from the fourth quarter of 2014), helped along by the growing content consumption on LinkedIn and the acquisition and integration of Bizo. Despite LinkedIn’s legacy as a job-hunters site, there’s eight times more engagement with content on the site than with jobs, according to yesterday’s Webinar moderator Senior Global Product Marketing Manager Selin Tyler.

But this slide from the LinkedIn Market Opportunity deck (this link opens a PDF) will give you an idea of how LinkedIn sizes the opportunity. There’s more to go.

Content That Serves A Purpose

In this space, LinkedIn is marketers’ top social focus, largely because that’s what the majority of financial advisors are paying attention to. Every mutual fund and exchange-traded fund (ETF) firm can establish a LinkedIn company page, post organic updates to it and hope to build followers and engagement. And, that will go so far. Those with a promotional budget can access LinkedIn’s sponsored updates for greater, targeted reach and visibility.

What can be expected of a sponsored update program? LinkedIn asked none other than BlackRock, one of its pioneering firms in the program since 2013, to sit for a Q&A.

I recommend this discussion to you not for its support of a LinkedIn product but for the insights provided on how to “craft” (a word used often) and manage content created for a purpose. It’s obvious that presenters Ann Hynek, managing editor of the BlackRock blog, and Lorin Suslow, social media marketing strategist in charge of the LinkedIn paid media program, have thought every detail through. Whether you’re a sponsored update advertiser or an organic update publisher, you’re likely to benefit from this discussion. My takeaways follow.

Planning

BlackRock sponsored updates are sourced from the BlackRock blog, which is by far the most prolific blog in the industry (and the most aggressive about seeking comments—see this post). Its focus is on investor education, retirement and pending market events that support BlackRock’s objective of raising retail awareness. Products are typically not mentioned.

Sometimes within firms, there can be tension between the editorial function of a blog and the needs of those in advertising. Suslow described a content planning collaboration that optimizes what’s needed for marketing. In addition to delivering on educational goals, content created needs to support the BlackRock and iShares brand themes. She looks at the available evergreen content and the planned content and performs a gap analysis, the result of which may require going back to Hynek and the blog contributors with additional requests.

Last year’s campaigns performed at four times the benchmark, Suslow said, due to the quality and variety of content offered via the sponsored updates.

Targeting

BlackRock’s best-performing sponsored update, shown below, produced 10 times the average CTR. I should say that I cobbled this screenshot together based on the organic update I found in BlackRock’s feed from November 2014. I’m not the audience BlackRock would have been targeting. What firm wouldn’t have been happy with the number of organic likes and comments shown on this update?

Such engagement is a function of reach and, to some extent, the number of followers. BlackRock uses sponsored updates to amp up both. The precision targeting available to target financial advisors and other professionals and/or people in key life stages are what drives the engagement “much higher” than on the organic updates, Suslow said.

Next up for BlackRock: Suslow said the firm soon will be using LinkedIn’s new Lead Accelerator. Lead Accelerator is a remarketing-like product using LinkedIn display and social ads, including sponsored updates, to nurture BlackRock Website visitors as they traverse the Web.

The Composition Of An Update

Pay attention to these marketers’ comments on the consideration given to each element of the update, and the continual adjustment, including A/B testing, involved. When something’s not working, they say, 90% of the time it’s the headline that needs help. It’s the content just 10% of the time, often involving updates that mention product.

Analytics

Suslow says she checks on the program’s performance twice a day. LinkedIn-provided analytics include impressions (is the target audience large enough?), engagement rate (a measure of campaign health and ad content health) and performance relative to the update benchmark. Each post is ranked as a strong performer, viral performer or poor performer.

Given that the updates all link to BlackRock’s blog, Web analytics are no doubt part of the performance analysis, although nothing was shared about that. I also would have liked to have learned about their analysis of likes, comments and shares, and the effect of influencers on virality.

Engagement Leaders And Popular Topics

Toward the end of the hour, program moderator Tyler walked through a few slides showing the best-performing sponsored updates of the quarter.

OppenheimerFunds, Goldman Sachs and Merrill Lynch were among the leaders, ranked by engagement rate.

She also shared a list of topics producing the most engagement (clicks+likes+comments+shares) among financial advisors in the first quarter of 2015.